If you’re looking for a way to earn interest in your cryptocurrencies, 2 platforms that you may have heard of include Anchor Protocol and Hodlnaut.

How are they different, and which should you choose?

Here’s what you need to know:

Contents

The difference between Anchor Protocol and Hodlnaut

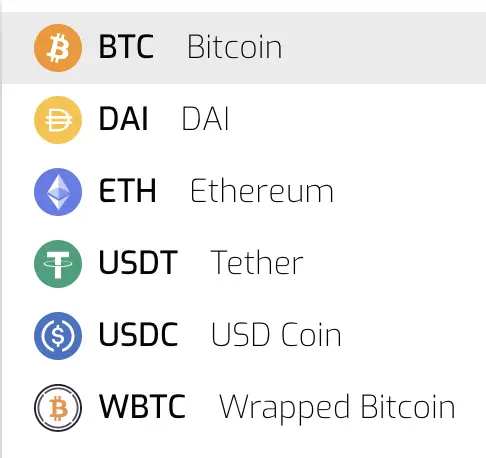

The Anchor Protocol is a decentralised platform that only allows you to earn interest on UST. Meanwhile, Hodlnaut is a centralised platform that allows you to earn interest on a wider variety of cryptocurrencies, such as BTC, DAI, ETH, USDC, USDT, and WBTC.

Supported cryptocurrencies

Here are the different cryptocurrencies that you can deposit into either account:

Anchor Protocol only allows you to deposit UST

The only cryptocurrency that you can deposit on Anchor Protocol is UST, which is an algorithmic stable coin.

This is a stable coin on the Terra Network, and you will need to have a Terra Station wallet to interact with this protocol.

Hodlnaut only allows you to deposit 6 coins

Hodlnaut’s offerings are quite limited as you can only deposit 6 coins into the platform.

These are the 6 currencies you can use:

Type of platform

Anchor Protocol is a decentralised platform. This is advantageous as you do not require to do any Know-Your-Customer (KYC) before you can use this platform.

All you’ll need is to connect your Terra Station wallet, and you can deposit UST straight into the protocol.

However, this means that it is also harder to navigate around the platform, especially if you are new to the decentralised finance (DeFi) world.

You will need to buy UST on a centralised exchange, before sending it to your Terra Station wallet and connecting with the Anchor Protocol.

Meanwhile, Hodlnaut is a centralised platform, where you are required to do KYC before you can use the platform.

Interest rate

For the Anchor Protocol, the platform aims to pay you a fixed ‘Anchor Rate’ that is pre-determined beforehand.

Currently, the rate fluctuates between 19.3% to 19.5%.

This is a rather high yield, especially since you are earning interest on a stable coin that is pegged to USD.

However, there is a chance that this yield may not be sustainable in the long run. If that is the case, the interest rate may drop eventually.

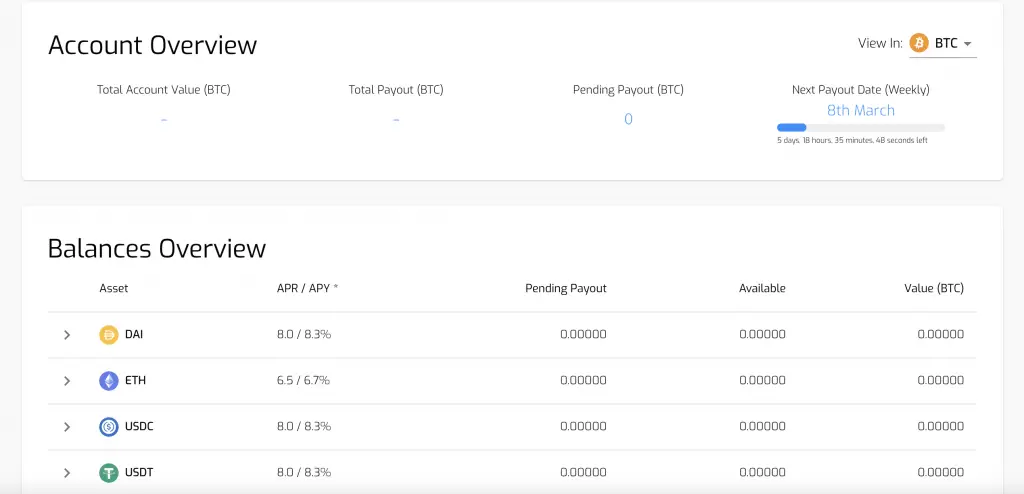

The interest rates that are provided by Hodlnaut are dependent on the cryptocurrency that you deposit on its platform.

These rates will be reviewed daily, and you will be informed of any changes to the rates.

How you earn your rewards

For the Anchor Protocol, you will be able to earn your interest in UST.

You can find out more about the differences between aUST and UST, and how this affects the interest that you earn.

For Hodlnaut, the interest is accrued at the end of every day. However, it will only be credited to your account every Monday.

Withdrawal fee

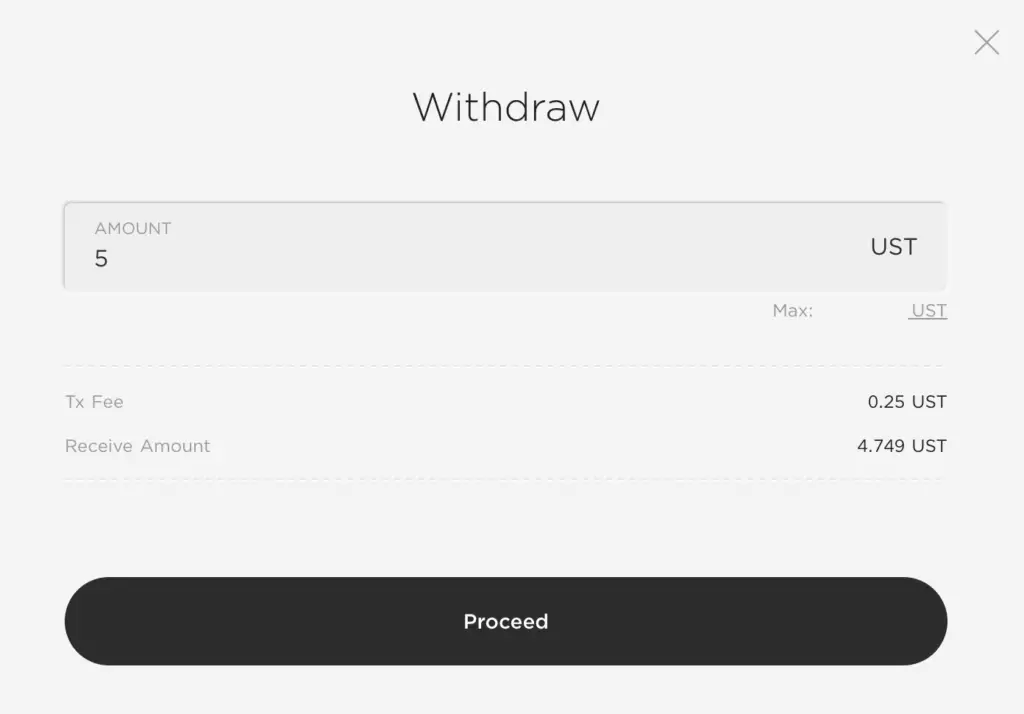

If you are looking to withdraw UST from the Anchor Protocol to your Terra Station wallet, you will be required to pay a transaction fee in UST.

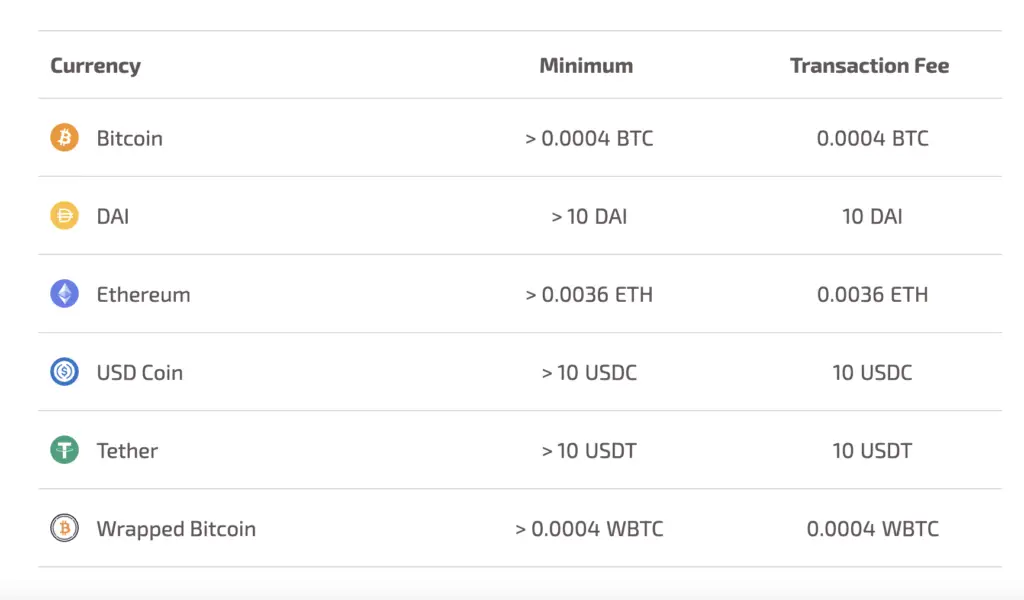

Hodlnaut charges one free withdrawal each calendar month, but you will need to pay a withdrawal fee for every subsequent withdrawal:

Lock-in period

Both platforms do not have any lock-in periods, and you are able to withdraw your funds at any time. This means that you are able to freely withdraw your crypto any time you wish!

Platform

For the Anchor Protocol, you are currently only able to access it via your desktop.

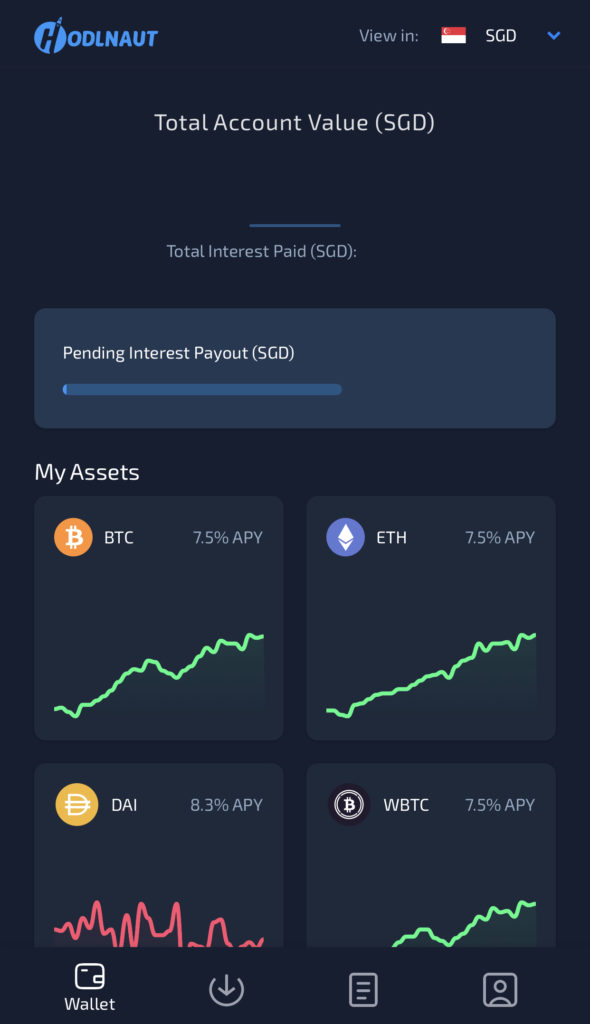

Meanwhile, Hodlnaut has both a desktop platform,

as well as a mobile app.

Security

The risk of your funds in the Anchor Protocol is dependent on 2 things:

- The safety of Anchor Protocol

- The safety of your Terra Station wallet

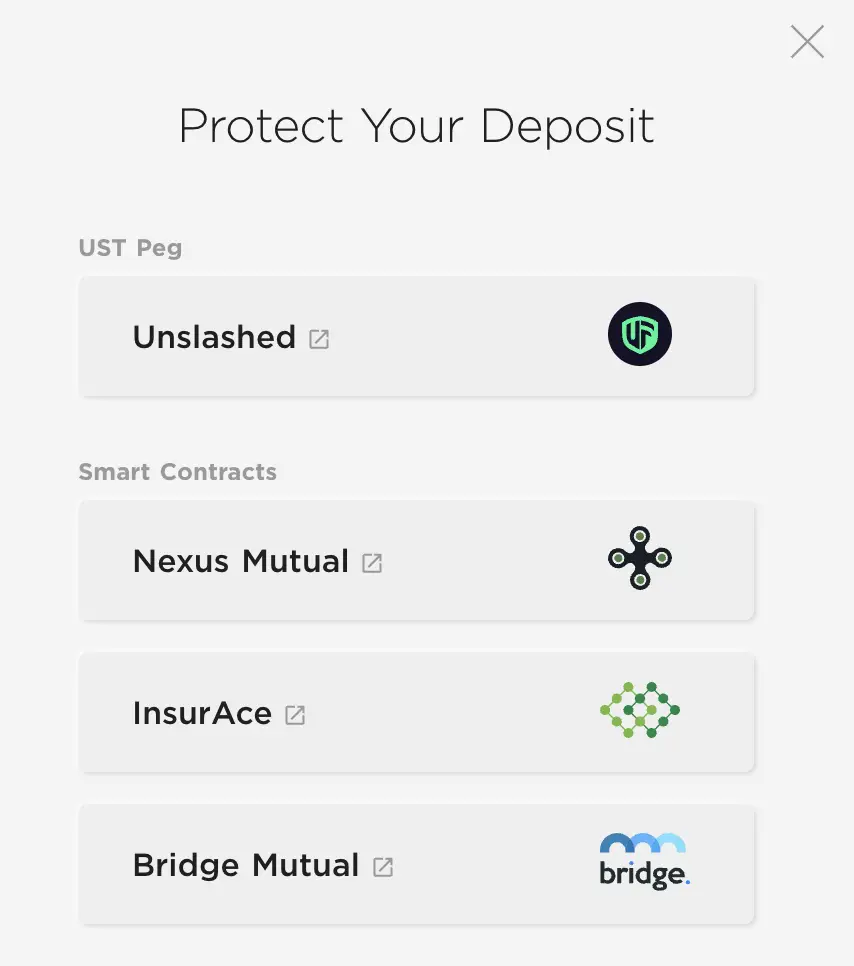

In the event that the Anchor Protocol fails, it is possible for you to buy insurance.

You can do this to provide cover against a smart contract failure, or if the UST loses its peg to the US Dollar.

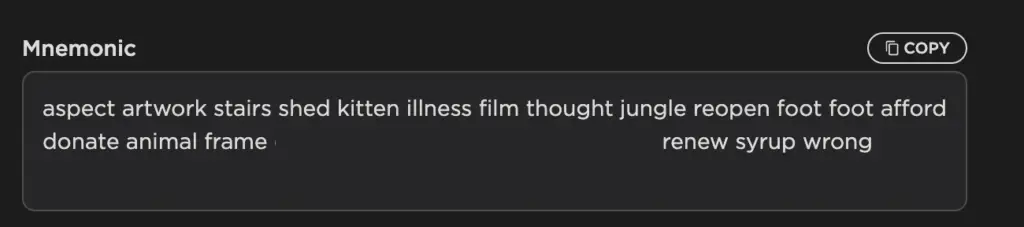

Another thing you’ll need to take note of is the security of your Terra Station wallet. When you are creating your wallet, you will be given a 24-word phrase.

It is important that you do not share this with anyone, as this phrase will allow anyone to gain access to your funds in your Terra Station wallet!

If you lose your 24-word phrase, you will be unable to recover your wallet in the future. As such, do remember to keep your phrases in a secure place!

Hodlnaut does not store your crypto on hot wallets

Hodlnaut stores your assets in a BitGo wallet when you deposit your funds to them.

Moreover, Hodlnaut does not have any hot wallets. This means that their crypto wallets are not connected to the internet.

This reduces the chances of your accounts being hacked!

Hodlnaut does not have any third-party insurance to cover any losses. However, they stated that they have set aside some of their profits to cover any losses due to hacks.

Verdict

| Anchor Protocol | Hodlnaut | |

|---|---|---|

| Cryptocurrencies | 1 (UST) | 6 |

| Interest Rates | 19.3% – 19.5 | Depends on cryptocurrency |

| Type of platform | Decentralised | Centralised |

| Withdrawals | Fee in UST | First withdrawal fee per month Depends on Currency |

| Lock-ins | None | None |

| Platforms | Website | Website and mobile app |

| Lock-in period | None | None |

| Security | Insurance and wallet safety | No hot wallet |

So which platform should you choose?

Choose Anchor Protocol for a high-interest rate

The Anchor Protocol provides a very high yield on UST, which is very advantageous since it is pegged to USD.

In this way, you do not experience as much volatility compared to a cryptocurrency.

However, it is much harder to access the Anchor Protocol as you will need to know how to:

You may also want to be very careful about the security of your Terra Station wallet!

Choose Hodlnaut to earn interest on a wider variety of cryptocurrencies

Hodlnaut allows you to earn interest on different cryptocurrencies, and not just on stable coins. This is useful if you want to earn interest in BTC, DAI, or other cryptocurrencies.

Conclusion

Both accounts allow you to earn extra interest on your crypto.

Here are some things you’ll need to consider:

- The type of currency you intend to hold

- The number of withdrawals you wish to make

- Whether you frequently use a web platform or mobile app

👉🏻 Referral Deals

If you are interested in signing up for any of the products mentioned above, you can check them out below!

Are you passionate about personal finance and want to earn some flexible income?