Last updated on June 6th, 2021

It is a tough time to own a business these days.

With so many uncertainties out there, it can be really hard to keep your business afloat.

Cash flow has always been a major problem for small and medium enterprises (SMEs) , and the COVID-19 pandemic has made things worse.

Both the government and banks alike have helped to ease cash flow problems, by providing relief for many SMEs.

But what if you need more cash on hand?

Here’s where InstaReM’s new service, BizPay, can help you out.

Contents

What Is BizPay?

If you have any unused credit card limits, BizPay enables you to to use this limit as working capital.

It may be hard for you to convince your suppliers to accept credit as a form of payment.

By converting your credit limit to cash, BizPay allows you to make direct payments to your suppliers or vendors.

This gives you much more flexibility to use your credit card for payments.

If you’d like to know more about BizPay, you can listen to their podcast below:

Why Is BizPay Better Than Other Options?

SMEs face many problems while receiving cash upfront.

Here are some of the issues that they face:

- Banks find it riskier to lend money to SMEs, hence banks are not able to provide enough support to SMEs

- Cash advances are extremely costly, and the fees outweigh any benefits of getting cash upfront

- P2P lending is an option, but high interest rates may make it an unsustainable option for long-term borrowing

With many SMEs still facing the cash crunch, BizPay is a platform that allows you to get cash from an alternate source.

How Does BizPay Work?

Here’s an example of how you can make payments using BizPay:

Payments can be made in 3 steps:

- Add a beneficiary (either local or overseas)

- Confirm transaction details (as per invoice)

- Add credit card details

Your beneficiary does not need to have a credit card. All you need is their bank account details.

This saves the hassle of your beneficiary needing to onboard onto the platform before you can send payments to them!

Interest free period

You will be able to enjoy an interest-free period from the time of payment to the due date of the credit card statement.

This interest-free period consists of both:

- Card billing statement (~30 days)

- Repayment period (~23-25 days)

Depending on the card that you use, you may enjoy an interest-free period of up to 55 days!

If you are doing a local transfer, your payments should be processed within minutes to your beneficiary.

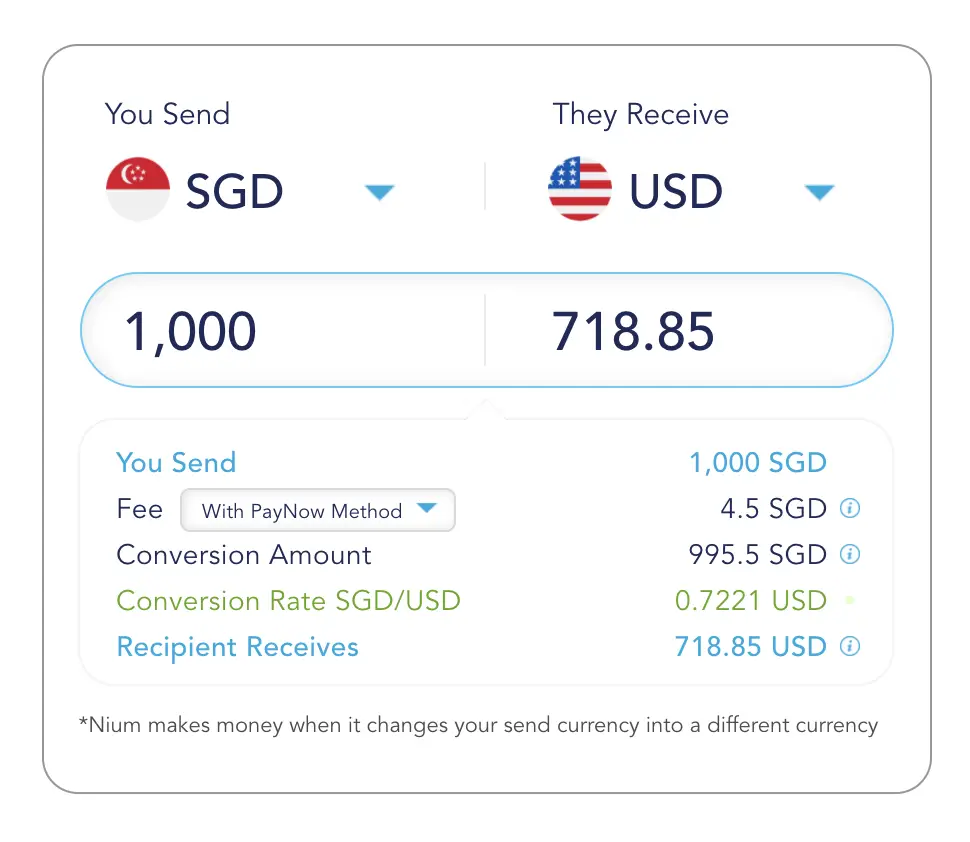

For overseas transfers, you will have to use InstaReM’s remittance service to transfer the money to your beneficiary.

It could take anywhere between minutes to 2 days depending on the receiving corridor (additional charges will apply).

To sum up, here’s how BizPay works:

What Are The Benefits Of BizPay?

You are able to enjoy 4 main benefits when using BizPay:

- Improve your cash flow with the interest free period

- Save on borrowing costs

- Make hassle-free payments

- Earn credit card benefits

The interest-free period gives you more flexibility in utilising your business’ funds. You are able to defer your payments, and save on borrowing costs as well!

InstaReM’s remittance service is competitive and reliable

By taking advantage of InstaReM’s remittance platform, you can enjoy fast overseas transfers at low fees.

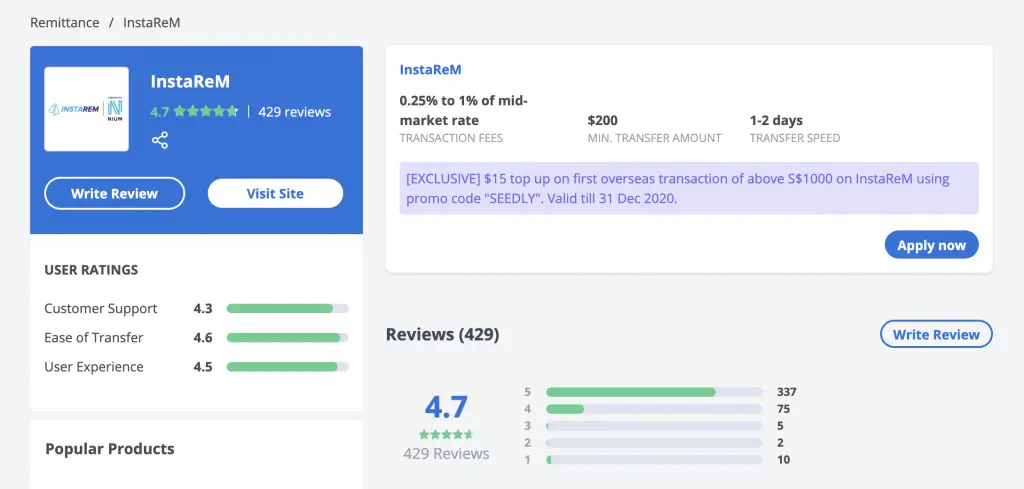

Based on reviews on Seedly, InstaReM’s overseas payment platform provides one of the fastest transfers, coupled with a competitive exchange rate.

Lastly, since you are using your credit card for spending, you get to enjoy benefits such as

- Membership reward points

- Cash rebates

- Air miles

Rewards are subject to an individual’s credit card’s terms and conditions.

What Are The Requirements To Use BizPay?

You’ll be required to set up an account with InstaReM.

InstaReM is regulated by the MOM, so you will need to submit your ACRA Business Registration too.

After registering your interest on their site, BizPay’s team will get in touch with you.

As soon as your account is created, you’ll be able to use this service!

What Are The Fees Being Charged?

InstaReM will charge platform fees of up to 2.5% when you use BizPay.

The platform fees may be lower, depending on which credit card you use!

These fees are deducted separately from your credit card. As such, your beneficiary still receives the actual amount as per the invoice.

Is BizPay Safe?

BizPay has the following security features listed below:

Moreover, you are required to enter your CVV for each transaction. This helps to ensure that your payments are more secure.

How Do I Start Using BizPay?

If you are interested to apply for BizPay, you can sign up using the link below.

You will need to fill up your details in the signup form, and InstaReM’s customer service team will reach out to you.

BizPay allows you to optimise your credit card limit in a more efficient manner.

In these unprecedented times, it could just be the difference that ensures your business’ survival.

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?

No Comments