Last updated on July 20th, 2022

You may have heard of the Enhanced CPF Housing Grant (EHG) which helps to offset the purchase price of your HDB flat.

However, how can you qualify for it and how much can you receive?

Here’s what you need to know.

Contents

- 1 What is the Enhanced Housing Grant (EHG)?

- 2 What’s the difference between the EHG and AHG?

- 3 Can I use the EHG to pay for my downpayment?

- 4 Who is eligible for the EHG?

- 5 Am I able to receive the EHG if I am a Permanent Resident (PR)?

- 6 Am I able to receive the EHG if I am a second-timer applicant?

- 7 Can I apply for the EHG if I am self-employed?

- 8 Does the EHG apply to resale flats?

- 9 How is my EHG calculated?

- 10 Does EHG include bonus?

- 11 When can I apply for the EHG?

- 12 Do I need to submit my marriage certificate when I apply for the EHG?

- 13 Is the EHG amount different if I apply for a mature estate?

- 14 Do I need to pay back the EHG?

- 15 Conclusion

What is the Enhanced Housing Grant (EHG)?

The Enhanced CPF Housing Grant (EHG) is disbursed to your CPF Ordinary Account (OA) to offset your flat’s purchase price or reduce your mortgage loan. You are able to receive a grant of up to $80,000, depending on your household’s gross average monthly income.

The EHG was introduced in September 2019, which combined the previous Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG).

The EHG has 2 main purposes

Here are the 2 main ways your EHG can be used for:

- Offset the purchase price of the flat

- Reduce the mortgage loan for the flat purchase

The EHG is meant to make the flat more affordable for you. As such, it will reduce the amount that you’re supposed to pay for your flat.

If you are taking a HDB loan, it may be possible to offset your entire downpayment. This depends on the amount of grants you receive!

If there is still an amount that’s left over, you can use it to reduce your mortgage loan as well.

Moreover, you are unable to use the EHG for certain fees, such as:

- Minimum cash downpayment

- Stamp duty

- Registration fees

- Conveyancing fees

- Monthly mortgage instalment payments

EHG is disbursed to your CPF account

When you receive your EHG amount, it will be directly credited into your CPF Ordinary Account. You will not receive any cash from this grant.

Only Singapore Citizens will receive the EHG in their CPF OA.

If you are married to a Singapore Citizen, both you and your partner will receive half of the total grant amount.

However, if you are the sole Singapore Citizen in the application, you will receive the entire grant amount.

What’s the difference between the EHG and AHG?

The EHG is a new grant provided for all households since 2019, with the total sum ($80,000) being the same as the older grants (AHG and SHG) combined ($40,000 + $40,000). This total amount is available for each applicant, irregardless of the type of flat and the location the flat is situated at.

The size and location of the flat that you buy no longer matters.

Previously, you would only be able to receive the SHG if you bought a 2-4 room flat which is in a non-mature estate.

However, these conditions are no longer required for the EHG!

This allows you to receive up to $80,000 if you fulfil certain criteria.

Can I use the EHG to pay for my downpayment?

You can use HDB Grants like EHG to pay for your entire downpayment if you are taking a HDB loan. If you are taking a bank loan, at least 5% of your downpayment has to be in cash. The EHG cannot be used to offset the minimum cash downpayment as it is disbursed to your CPF.

Here is the downpayment amount you’ll need to pay, depending on the type of loan that you take:

| Type of Loan | Downpayment | Additional Payment During Key Collection |

|---|---|---|

| HDB Loan / Not taking any loan | 15% of purchase price (Cash or CPF) | None |

| Bank Loan (Loan Ceiling of 75%) | 20% (minimum 5% Cash, remaining can be Cash or OA) | 5% (Cash or CPF) |

| Bank Loan (Loan Ceiling of 55%) | 20% (minimum 10% Cash, remaining can be Cash or OA) | 25% (Cash or CPF) |

If you are taking a HDB loan, the entire downpayment can be paid for using your CPF. In this case, the EHG can be used to pay your entire downpayment.

However if you take a bank loan, you’ll need to pay 5% or 10% of your downpayment in cash.

Since the EHG is disbursed to your CPF account, it cannot be used to pay the cash component!

However, the EHG still can help to offset the remaining amount that can be paid by your CPF.

The housing grant (EHG) does not reduce your downpayment value

You may want to note that the grant that you receive does not reduce the amount of downpayment that you need to pay.

For example, you may need to pay $50k as your downpayment for a $330k flat (if you are taking a HDB loan).

Furthermore, you are eligible for $50k from the EHG.

This means that you can use $49.5k from your $50k grant to pay for your downpayment.

The remaining amount can be used for other housing-related expenses which you can pay using CPF.

The downpayment you need to pay will still be 15% of your flat’s value (if you are taking a HDB loan). The EHG will not offset your flat’s value!

Who is eligible for the EHG?

To be eligible for the EHG, at least one of your household members must have worked continuously for the past 12 months. Furthermore, your average monthly household income must be below $9,000 (or $4,500 for the EHG singles grant).

At least one of your household members needs to have worked continuously for the past 12 months.

If you have been working for the past 12 months, but your spouse has not, you still will be eligible for the grant!

There are also other eligibility criteria that you’ll need to meet, such as:

- Remaining lease of flat (≥ 20 years)

- No ownership / interest in property

- Being first-timer applicants

A first-timer applicant is one who has not received any HDB subsidy before.

If you fall under a certain group of people listed below, you will be eligible for the EHG:

- First-timer couples

- Singles

- Non-citizen spouse

First-timer couples

If both you and your partner are first time applicants when purchasing a HDB flat, you are able to receive up to $80,000 worth of grants. The amount that you receive depends on your household’s average gross monthly income, which should not exceed $9,000.

For first-timer couples, you are able to receive the maximum amount of grants (up to $80,000)

The lower your income, the higher the grants you’ll be able to receive.

Singles

If you are applying for a HDB flat as a single, you are able to receive up to $40,000 worth of grants under the EHG (Singles) grant. The amount you receive depends on your household’s average gross monthly income.

If you are a first-timer single who is above 35 years old and applying for a HDB flat, you will be eligible for the EHG (Singles) grant.

The amount you can receive is up to $40,000, which is half of the $80,000 for a first timer couple.

The amount of grants you receive also depends on your household’s average monthly household income.

You’ll have to take note of the income ceiling, which is only up to $4,500. If you earn more than that, you will be unable to receive the EHG (Singles) grant!

However, there are 2 other grants that you can receive from HDB too:

- Singles Grant (Up to $25,000)

- Proximity Housing Grant (Up to $15,000)

Even if you don’t qualify for the EHG, you may be able to receive some grants!

Non-citizen spouse

You are able to apply for a both a new flat or resale flat under the Non-Citizen Spouse Scheme, if your spouse is neither a Singapore Citizen or Permanent Resident (PR). In this scenario, you are eligible for the EHG (Singles) grant, which you can receive up to $40,000.

If you are applying for a new flat under the Non-Citizen Spouse (NCS) Scheme, you are unable to apply for a HDB flat. Instead, you can only buy a 2-Room Flexi Flat.

You’ll also receive the same amount of grants as you were applying as a single.

This also means that only half of your household’s gross average monthly income is considered.

As such, you can only receive up to $40,000 worth of grants.

The grant will only be disbursed into the CPF Ordinary Account of the Singapore Citizen.

The income ceiling is also $4,500. If you are above the income ceiling, you will not receive any grants!

Am I able to receive the EHG if I am a Permanent Resident (PR)?

The EHG is only disbursed to the CPF Ordinary Account of Singapore Citizens. If you are a Permanent Resident and are applying for the EHG with your partner who is a Singapore Citizen, the entire grant amount will be disbursed to your partner.

If you are a PR, you will not be able to receive any amount of the grant in your CPF!

Am I able to receive the EHG if I am a second-timer applicant?

If you are a second-timer applicant, you are only eligible for the Step-Up CPF Housing Grant, and not the EHG. However, if you are a second-timer applicant while your partner is a first-timer, you may be eligible for the EHG (Singles) grant. This means that you’ll only receive a grant of up to $40,000.

When you receive this grant, only half of your household’s monthly average income is taken into consideration.

This is similar to if you’re applying for a HDB as a single or if you have a non-citizen spouse.

Can I apply for the EHG if I am self-employed?

HDB did not place any restrictions on the type of employment status you need to have to be eligible for the EHG. You can be self-employed and apply for the EHG, so long as you have worked for at least 12 months.

When you are applying for the EHG, you will need to produce certain income documents, depending on your employment status.

HDB will use these income documents to calculate your gross average monthly income.

The process is the same, whether you are working full-time or self-employed.

As such, you are still able to apply for the EHG, even if you are self-employed!

Does the EHG apply to resale flats?

The EHG is also applicable to both new flats, as well as resale flats. You are able to receive up to $80,000 or $40,000, depending on your household’s average monthly household income.

As such, it does not matter whether you apply for a resale or a new flat. You still will be able to receive the same amount of grants!

You can receive up to $80,000 worth of grants for the following scenarios:

- Both you and your partner are first-timer applicants

- Both you and another single are first-timer applicants (under the Joint Singles Scheme)

For all other types of applicants, you can only receive up to $40,000 under the EHG (Singles) grant:

- First-timer and second-timer couple

- Non-citizen spouse

- Single Singapore citizen

- Joint singles or orphans

How is my EHG calculated?

The amount of grants you receive from the EHG depends on your household’s gross monthly average income. The lower your household’s average income, the higher amount of grants you will receive (up to $80,000).

HDB calculates your household’s gross monthly average income to determine the amount of grants you’ll receive:

| Average Monthly Household Income | EHG Amount |

|---|---|

| ≤ $1,500 | $80,000 |

| $1,501 – $2,000 | $75,000 |

| $2,001 – $2,500 | $70,000 |

| $2,501 – $3,000 | $65,000 |

| $3,001 – $3,500 | $60,000 |

| $3,501 – $4,000 | $55,000 |

| $4,001 – $4,500 | $50,000 |

| $4,501 – $5,000 | $45,000 |

| $5,001 – $5,500 | $40,000 |

| $5,501 – $6,000 | $35,000 |

| $6,001 – $6,500 | $30,000 |

| $6,501 – $7,000 | $25,000 |

| $7,001 – $7,500 | $20,000 |

| $7,501 – $8,000 | $15,000 |

| $8,001 – $8,500 | $10,000 |

| $8,501 – $9,000 | $5,000 |

If you are applying for the EHG (Singles) grant, you can only receive up to $40,000.

| Average Monthly Income | EHG (Singles) Amount |

|---|---|

| ≤ $750 | $40,000 |

| $751 – $1,000 | $37,500 |

| $1,001 – $1,250 | $35,000 |

| $1,251 – $1,500 | $32,500 |

| $1,501 – $1,750 | $30,000 |

| $1,751 – $2,000 | $27,500 |

| $2,001 – $2,250 | $25,000 |

| $2,251 – $2,500 | $22,500 |

| $2,501 – $2,750 | $20,000 |

| $2,751 – $3,000 | $17,500 |

| $3,001 – $3,250 | $15,000 |

| $3,251 – $3,500 | $12,500 |

| $3,501 – $3,750 | $10,000 |

| $3,751 – $4,000 | $7,500 |

| $4,001 – $4,250 | $5,000 |

| $4,251 – $4,500 | $2,500 |

Exceptions for students

You may think that if you apply for a BTO as students, you would receive the highest amount of grants as you’ll have almost no income.

However, this may not be the case! The EHG requires you to have worked for at least 12 months before you are eligible for the grant.

If both you and your partner are university students at the point of application, you would not have any working experience at all!

This is where the Deferred Income Assessment comes in. Your income assessment will be deferred to around 3 months before your flat has been completed.

At that point in time, both you and your partner may have started working already. As such, the amount of grant that you’ll actually receive may be lower than what you’ve expected!

This is something you’ll need to plan with your partner and see if the amount of grants that you’ll be eligible for.

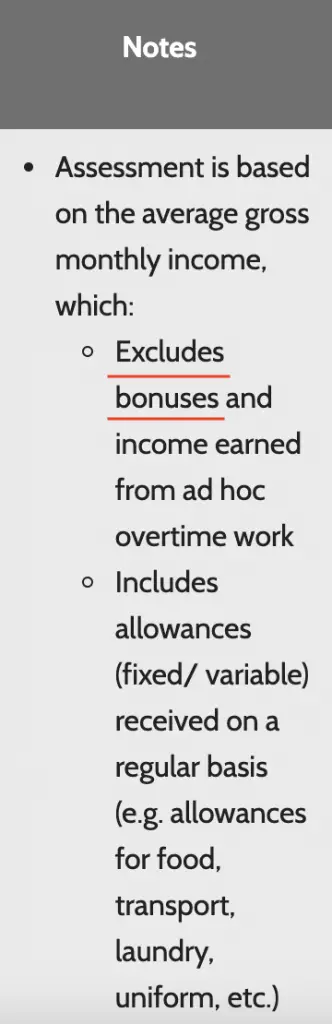

Does EHG include bonus?

The amount you receive from the EHG depends on your household’s gross average monthly income. However, HDB does not include the bonus you receive as part of your individual average monthly income. As such, your bonus will not affect the amount of EHG that you receive.

HDB’s website states that they do not consider your bonus to be part of your average gross monthly income.

As such, you do not need to worry about your bonus causing you to receive a lower EHG amount!

When can I apply for the EHG?

If you wish to apply for the EHG, you will need to complete the EHG application form and submit it to HDB when you attend your appointment to book your flat. You will need to provide the necessary income documents for HDB to process your grant, unless you are able to defer your income assessment.

Do I need to submit my marriage certificate when I apply for the EHG?

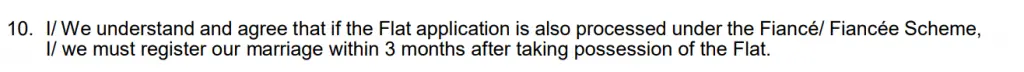

If you are applying for the EHG under the Fiancé / Fiancée Scheme, you would need to submit your marriage certificate within 3 months of taking possession of your flat.

This clause is explained in the EHG application form:

As such, you may need to plan your timeline out well enough, so that you will be able to submit your certificate in time!

Is the EHG amount different if I apply for a mature estate?

The EHG disbursed to you will be of the same amount, irregardless of whether you purchase a flat that is in a mature or non-mature estate. This is different from the previous Special Housing Grant (SHG), which is only disbursed if you are applying for a new flat in a non-mature estate.

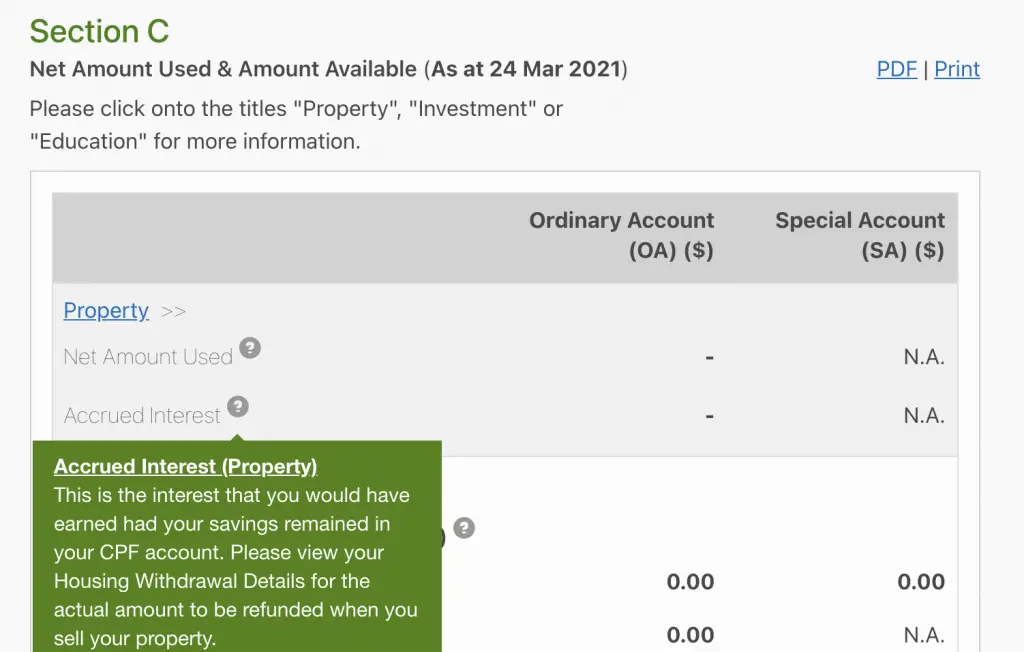

Do I need to pay back the EHG?

When you sell your HDB flat, you will have to return the amount that you received from any HDB grants (including the EHG) back to your CPF Ordinary Account. This also includes the accrued interest that the amount would have received if it remained in your CPF Account.

After selling your flat, the funds you used from your CPF OA to pay for your flat will be returned back with interest. This also includes the money you received from any CPF grants like the EHG.

The CPF Board provides an explanation of how the accrued interest is calculated.

However, it can be really confusing to keep track. This is especially so if you’re using your CPF OA to pay for your housing loan!

If you would like to see your accrued interest, you can go to CPF Online Services and view ‘My Statement’.

Conclusion

The Enhanced CPF Housing Grant (EHG) can be very helpful in lowering your new or resale flat’s purchase price.

This can really help to reduce the financial burden of buying a house!

However, you may want to take note of the repayment of the grant when you sell your flat.

You will need to return the grant, as well as the accrued interest, back to your CPF OA.

This is something you’ll need to consider if you intend to sell your flat in the future!

If you’re looking for furniture to spruce up your home, you can check out the latest deals on Noa Home (Singapore).

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?