Last updated on July 20th, 2022

You may be considering applying for an HDB flat, but one of the eligibility criteria is the income ceiling.

This income ceiling, or average gross monthly household income, is also applicable when you are applying for your CPF Housing Grants.

The way that HDB calculates the formula may be different from what you think!

Here’s what you need to know to determine your household’s income ceiling:

Contents

- 1 How to calculate your income ceiling for your HDB flat

- 2 What is considered as part of my income?

- 3 Does HDB consider my bonus when calculating the income ceiling?

- 4 Does HDB include my CPF contribution when calculating the income ceiling?

- 5 Does HDB include my commissions when calculating the income ceiling?

- 6 How to calculate income ceiling for CPF Housing Grants

- 7 A common misconception of the formula

- 8 Some examples

- 9 Conclusion

How to calculate your income ceiling for your HDB flat

Here are the steps you’ll need to determine the average gross monthly household income for your household:

- Calculate the total gross income for each household member

- Divide the total income by the specified time period (3-6 months) depending on the type of income earned

- Add up the total gross income for your entire household

The process is the same when calculating your income ceiling to be eligible for either a HDB flat or an Executive Condominium (EC).

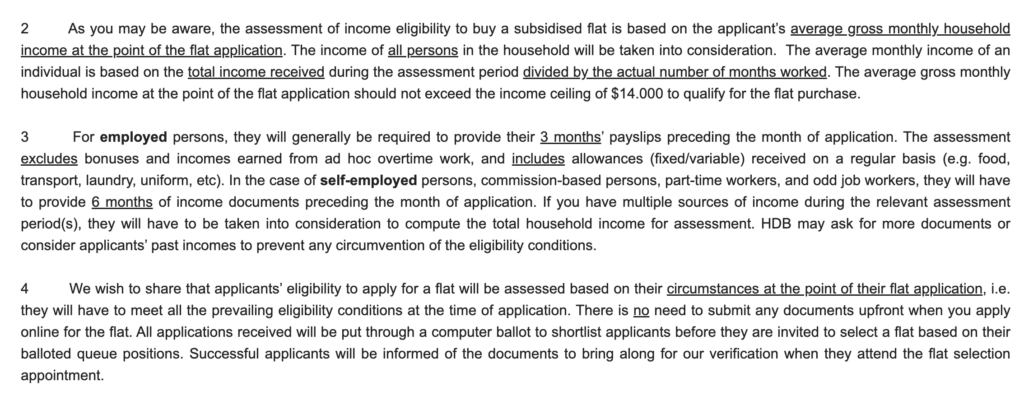

The income ceiling is determined by calculating your average household income over the past 3-6 months.

It is not by calculating the average household income per household member!

Here is a further explanation on how this calculation is done:

#1 Calculating your total gross income for a certain period

When you are applying for your flat, you will need to prepare some income documents. These documents will be submitted to HDB when you make an appointment to book your flat.

The income assessment for your HDB eligibility is different from the eligibility assessment for a CPF Housing Grant.

For employed workers, your income is only assessed 3 months before your HDB application.

For all other types of workers (e.g. self-employed or part-time worker), your income will be assessed 6 months prior to your application.

The type of income documents depend on the nature of your employment:

- Employed person

- Self-employed person

- Part-time worker

- Commission-based person

- Odd job worker

- Unemployed (between 18-62 years old)

You can view all the required documents you need to submit on HDB’s website. This can be found under the section ‘What income documents must I submit?‘.

#2 Divide the total income by the specified time period (3-6 months) depending on the type of income earned

After calculating the income you’ve earned for the past 3-6 months, you’ll need to divide it over the number of months that you’ve worked.

This will give you your personal average monthly income.

However, HDB is looking at the average monthly income of the household that is applying for the flat.

#3 Add up the total gross income for your entire household

First, you’ll need to calculate the average monthly income for each of your household member.

After that, you’ll need to add up all your household member’s average monthly income to get your household average monthly income!

If you are just applying for the flat with your spouse or fiancé(e), it will be the total income that both of you have received.

You may think that the average income depends on the number of household members that you have.

However, that is not the case!

Instead, it depends on the total income that your entire household earns for a certain time period.

Here is an email which I received from HDB regarding this enquiry:

Some examples

Here are some examples of how the income ceiling calculation is done:

1. You and your spouse are working full-time

Let’s say both you and your spouse have been working full-time for the past 3 months.

This is how much you and your spouse are earning per month:

| You | $3,000 |

| Your Spouse | $3,200 |

In this case, your average monthly household income will be $6,200 for the past 3 months.

[($3,000 * 3) / 3] + [($3,200 * 3) / 3] = $6,200

2. You are working full-time, while your spouse is self-employed

You may be working full-time, while your spouse is self-employed.

In this case, your income is assessed for the past 3 months. Meanwhile, your spouse’s income will be assessed for the past 6 months.

This is how much you and your spouse are earning per month:

| You | $3,000 |

| Your Spouse | $3,200 |

Your average monthly household income will still be $6,200!

($3,000 * 3) / 3 + ($3,200 * 6) / 6 = $6,200

As such, the average monthly household income would only change if either you or your partner earns a variable income.

Income ceiling for different types of flats

To be eligible to buy a HDB flat or EC, your household’s average gross monthly income must be below the income ceiling for that type of flat.

| Type of Flat | Income Ceiling |

|---|---|

| 4-room flat or bigger | $14,000 or $21,000 (if purchasing with extended or multi- generation family) |

| 3-room flat | $7,000 or $14,000 (depending on project) |

| EC | $16,000 |

If you are above the income ceiling, you will be unable to purchase the flat or EC! You will not be able to take a HDB loan as well.

What is considered as part of my income?

HDB uses your gross monthly income to calculate your household’s income ceiling.

However, apart from your income, you may receive other benefits like your bonus!

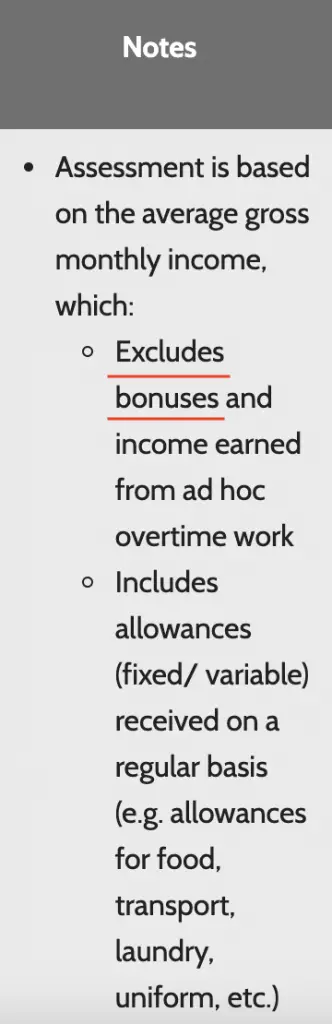

So what is considered as your income? HDB defined what is included as your income and what isn’t:

| Considered As Income | Not Considered As Income |

|---|---|

| Allowances on a regular basis (e.g. food, transport etc.) | Allowances (alimony, NS, overseas scholarship and cost of living) |

| Sustenance allowance | Bonuses |

| Stipend | Rental income |

| Pension | |

| Interest from deposit accounts | |

| Income from ad hoc OT work | |

| Director’s fee |

Does HDB consider my bonus when calculating the income ceiling?

HDB does not consider your bonus when calculating your average gross monthly household income, even for Executive Condominiums (ECs). This is different from the Ministry of Manpower which includes your bonus in their ‘Gross Monthly Income From Work’.

On HDB’s website, it states that it excludes your bonus when calculating your average gross monthly income.

As such, only your gross monthly pay will be considered when HDB calculates your income ceiling.

Does HDB include my CPF contribution when calculating the income ceiling?

HDB considers your gross monthly income when calculating your income ceiling. This includes the CPF contributions that you made for that month. However, your employer’s CPF contributions will not be factored in.

Here is the definition of ‘Gross Monthly Income From Work‘, as defined by the Ministry of Manpower:

For employees, it refers to the gross monthly wages or salaries before deduction of employee CPF contributions and personal income tax.

It comprises basic wages, overtime pay, commissions, tips, other allowances and one-twelfth of annual bonuses.

MOM

The definition is very similar to what the HDB will calculate. As such, only your CPF contributions will be considered, but not your employers!

It is interesting to see that MOM does consider your bonus to be a part of your income, but HDB does not.

Does HDB include my commissions when calculating the income ceiling?

If you are a commission-based worker, your commissions are considered as part of your household’s income ceiling calculation. You will need to produce your commission statements 6 months before the month of your HDB application.

If you are applying for a CPF Housing Grant, you’ll need to provide your CPF payments for the past 12 months too.

The 6 months income assessment is only to see if your household is eligible to purchase the flat!

How to calculate income ceiling for CPF Housing Grants

Here are the steps you need to calculate the income ceiling for your CPF Housing Grant:

- Calculate the total gross income for each household member for the past 12 months before your application

- Divide the total income by the number of months you have worked

- Add up the total average gross income for your household

The steps are somewhat similar to the ones you need to calculate your eligibility for a HDB flat or EC.

However, the calculation of your income ceiling for the Housing Grant is different from your HDB or EC eligibility.

To first be eligible for any of the Housing Grants, you or any applicant has to work continuously for 12 months before making the application.

For couples who are still studying or recently graduated, you are able to defer your income assessment until closer to the collection of your keys.

As such, the income ceiling assessment period for the Housing Grants is 12 months.

This is different from the income ceiling assessment to determine if you are eligible to purchase a HDB flat. The assessment period is between 3-6 months, depending on the income that you earn.

If you want to apply for a Housing Grant, you’ll need to prepare 2 separate income documents:

- Income documents to assess your eligibility to buy a flat (3-6 months)

- Income documents to assess your eligibility for a CPF Housing Grant (12 months)

Both of these documents will need to be submitted during your appointment to book your flat.

This is the period where you’ll need to pay your option fee as well.

One thing you may want to take note of is that you’ll need to provide your CPF statements if you’re an employed or a commission-based person.

The CPF statements are not required for your flat eligibility income assessment!

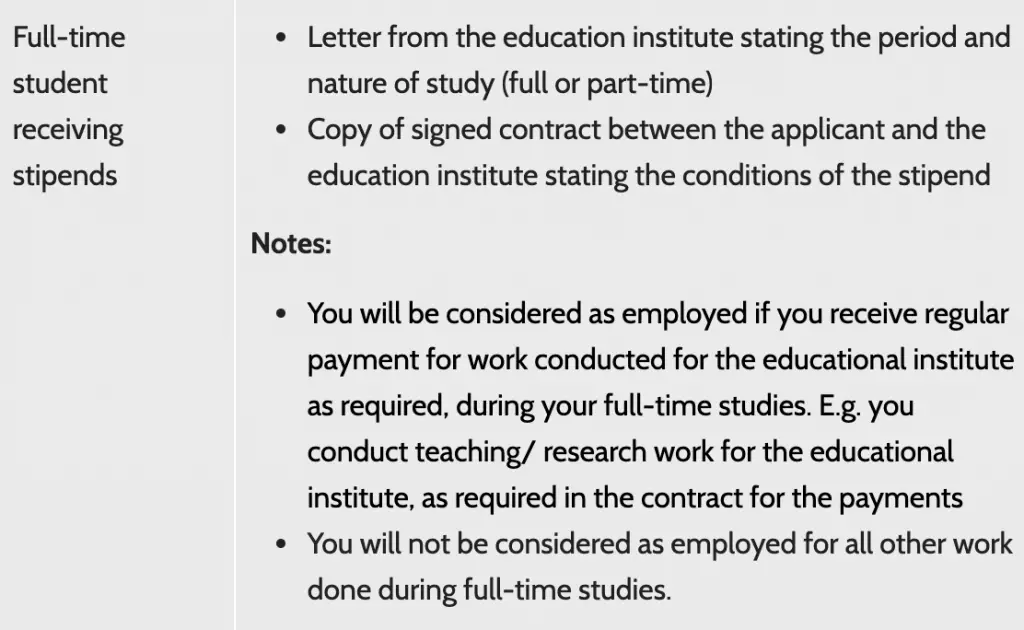

You’ll also need to declare the stipends that you’re receiving if you’re a full time student.

This is not something you’ll need to declare for the income ceiling for your HDB flat eligibility.

A common misconception of the formula

You may think that the monthly household income is calculated using this formula:

(Your salary + Your spouse’s salary) / 2

However, this is not the case!

HDB considers the entire income that both you and your spouse or fiancé(e) has earned over the past 12 months.

Some examples

Here are some examples to illustrate how your average monthly income is calculated:

#1 Both are working for the past 12 months

Let’s say both you and your spouse have been working for the past 12 months:

| You | $2,700/month |

| Your Spouse | $3,000/month |

In this case, the calculation is really straightforward. The average monthly household income will be $5,700/month.

[($2,700 * 12) / 12)] + [($3,000 * 12) / 12] = $6,000

#2 One of you just started work 6 months ago

To meet the eligibility for the Enhanced CPF Housing Grant (EHG) as a first-timer, either you or your spouse / fiancé(e) must have worked continuously for the past 12 months.

However, both of you may have started work at different times!

You may have worked for the past 12 months, while your spouse recently got a job for the past 6 months.

| You | $2,700/month (12 months) |

| Your Spouse | $3,000/month (6 months) |

Your average gross monthly household income will still be $5,700/month.

[($2,700 * 12) / 12] + [($3,000 * 6) / 6] = $5,700

Conclusion

The way that HDB calculates your income ceiling may be different from what you think!

You may think that it is just dividing the total income that you and your household members earned for that month.

However, here is the actual formula that HDB uses:

(Total income earned over x months / x months) for each household member

x can be 3, 6, or 12 months, depending on your application.

By knowing how the income ceiling is calculated, it may help you to understand your eligibility better!

You can find out what happens when your BTO queue number exceeds the total flat supply here.

If you’re looking for furniture to spruce up your home, you can check out the latest deals on Noa Home (Singapore).

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?