Last updated on March 8th, 2022

Tencent is one of three internet giants in China alongside Baidu and Alibaba.

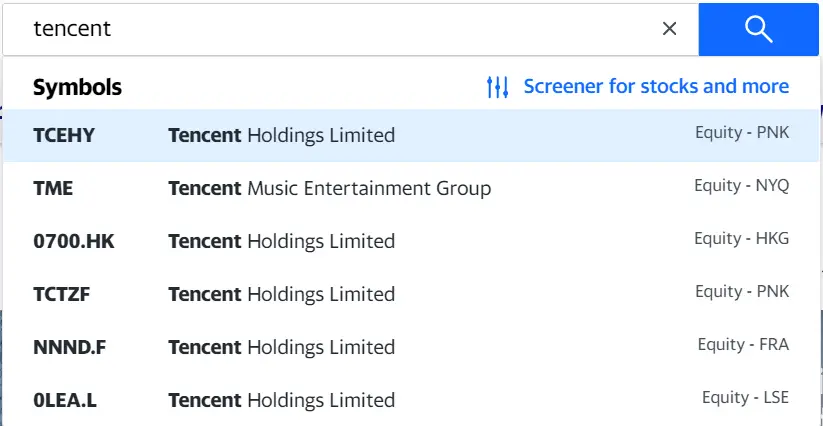

As a public company, Tencent has since been listed in various markets and exchanges. Each has a different ticker symbol to represent it. It may be confusing when we first see them as some of them look quite similar!

Out of the many different symbols of Tencent, two of them, TCEHY and TCTZF, will be the focus of this article.

Here’s what you need to know about these 2 stocks.

Contents

The difference between TCEHY and TCTZF

Both TCEHY and TCTZF are listed on the US OTC market. However, TCEHY represents an ADR while TCTZF represents an ordinary share of the company. In addition, they differ in the currency of the dividends paid out and their trading volume.

Before we go into their differences, it may be worthwhile to understand the over-the-counter (OTC) markets in general.

Over-the-counter (OTC) refers to the process of how securities are traded via a broker-dealer as opposed to on a centralized exchange.

Investopedia

There are many types of OTC markets. The popular ones include:

Both TCEHY and TCTZF are listed on the Pink Open Market, also known as the Pink Sheets.

Historically, pink sheets got their name from the color of the paper on which quotes of share prices were published.

Investopedia

But wait, why do companies choose not to list their stocks on a major US exchange like Nasdaq instead?

The main reason is because they do not wish to or cannot meet the listing requirements. Some of the concerns include:

- the size of the company

- liquidity of the shares

Furthermore, the listing fees are rather high. This has discouraged companies from taking action. A known figure for a Nasdaq listing is said to be at a minimum of $150,000!

However for Tencent, they are big, popular and rich enough. It is still unknown why they chose to trade on the OTC markets.

Nonetheless, the OTC markets have their own set of pros and cons for companies. On one hand, their lack of regulation supports stronger growth in capital. This is due to easier access for US investors to trade. On the other hand, OTC stocks often have low liquidity and high volatility.

In Tencent’s case, its OTC stocks are not so much affected by the cons. This is because the company itself is well liked among investors. Furthermore, their overall stock performance seems to follow that of their Hong Kong stock, 0700.

Now, we have gained an understanding of the US OTC markets and what it entails for its stocks. Let’s start comparing between TCEHY and TCTZF!

Type of holding

Shares of TCEHY are American Depository Receipts (ADRs). Meanwhile, shares of TCTZF are ordinary shares of Tencent.

ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors.

Fidelity

ADRs will expose more risks to the investor. This is due to exchange rate fluctuations between Hong Kong and the US. These fluctuations are in turn influenced by political events and inflation in the United States.

As such, they may not be attractive if you’re a non-US investor.

In this case, TCTZF might be a better choice if the intention is to steer clear of this currency risk.

You can identify an ADR by googling the stock code. You should see ‘ADR’ at the back of the stock name.

Whether you are holding one stock or the other, there is a dominant factor. Both of them are part of a Variable Interest Entity (VIE) structure. In other words, the investor is technically not having an ownership in the company, but rather the VIE.

A variable interest entity (VIE) refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights.

Investopedia

This also means that you will not have voting rights if you buy into either share.

In addition, there is a risk that China may clamp down on these VIEs and render the shares invalid. This is certainly undesirable!

While this possibility may be low, we still would not want to ignore it.

As such, if you are intending to invest in Tencent, it will be useful to take note of these risks.

Difference in currency for dividends

Tencent has been giving out dividends to its investors for more than 10 years. As investors of TCEHY or TCTZF, you will also be entitled to receive those dividends.

However, the currency of those dividends will differ, depending on the type of stock you own. For TCEHY, the dividends are in USD. For TCTZF, the dividends are in HKD.

The difference may seem odd, especially since both shares can be bought in USD.

If you are investing in Tencent for their dividends, you would want to receive the most accurate amount. However, with exchange rate fluctuations in play, this is not always possible.

This risk would affect you depending on the currency of your brokerage account. Assuming that you have a US stock account, owning TCEHY would not affect you as they are the same currency. However, if you own TCTZF, the process of exchanging currency on the platform may reduce your dividends.

With a Hong Kong stock account, the situation reverses. Owning TCTZF will be in your favour, while buying TCEHY is not favourable.

This knowledge could be valuable to take note for a dividend investor!

Difference in trading volume

OTC stocks have a reputation for facing low trading volume. This is a result of the challenging process of trading.

In spite of that, Tencent is big and popular enough to be unconventional.

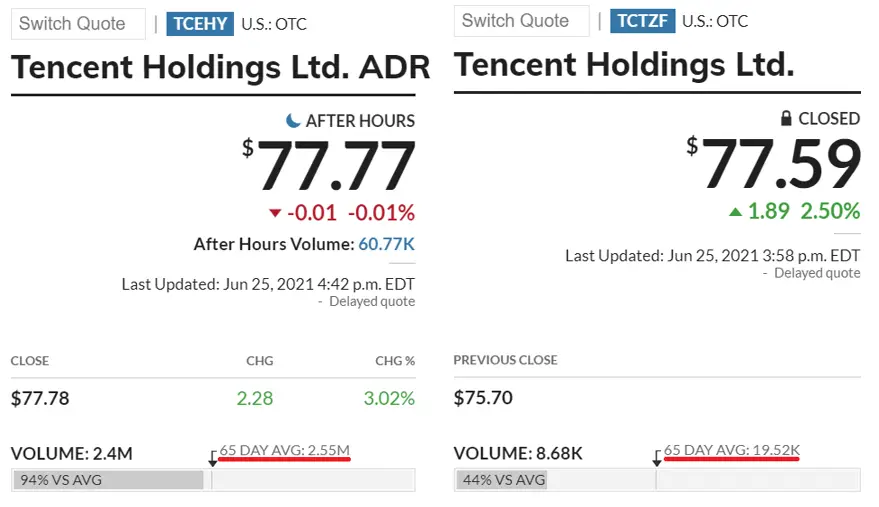

In terms of their 65-day average volume, TCEHY and TCTZF have 2.55 million and 19.52 thousand respectively.

TCEHY’s trading volume is way higher than TCTZF!

High trading volumes for a stock tend to be considered as high in liquidity. With higher liquidity also comes greater swings in the market. This could be a factor depending on your risk appetite.

If you have a low risk appetite, you might not be comfortable with those ups and downs in the stock price. However, if you have a high risk appetite, you would have no problems sitting on the stock while the market does its thing.

That being said, high liquidity may lead to high returns as well. As a result, TCEHY may be more attractive to you in this aspect.

TCEHY shares can be converted to the ordinary shares whereas TCTZF shares cannot.

This is because TCEHY shares are actually ADRs.

If you want to reduce your risks of holding ADRs, you might be better to convert your TCEHY shares to 0700 shares.

Converting between TCEHY and 0700

Let’s say that you decide to convert between TCEHY and 0700.

This can be done with the following steps:

- Find a broker that has access to Pink Sheets and the Hong Kong Exchange

- Follow the procedures of the broker to convert them

The official conversion rate for these two ticker symbols is 1-to-1.

However, this conversion can be quite expensive.

For example, Interactive Brokers charge a number of fees to help you convert, like

| Type | Cost |

|---|---|

| Creation fee | 0.05 USD/share |

| Processing fee | 500 USD |

| Cable wire fee | 17 USD |

Not only that, there are risks involved in these conversions, such as

- price fluctuations

- exchange rate fluctuations

As the costs of these fluctuations are paid by you, it is helpful to account for these losses when deciding to interconvert these shares.

Verdict

After doing a comparison of the two OTC stocks, let’s summarize them:

| TCEHY | TCTZF | |

|---|---|---|

| Type of Holding | ADR (VIE) | Ordinary share (VIE) |

| Currency of Dividends | USD | HKD |

| Trading Volume | High | Low |

| Fungibility | Yes | No |

Choosing between these two stocks may be difficult. Here are some points you can consider in your decision:

#1 Type of holding

Investing in ADRs may put you through unnecessary currency risks. With the option of buying the same stock as an ordinary share instead, TCTZF seems to look more appealing.

However, if you are able to tolerate the risks, this factor may not be that important.

#2 Dividend currency

The currency of your dividends will affect the amount that you collect. Before deciding which stock to choose from, you may want to consider two things, including:

- the currency of your stock account

- your comfort level with the currency risks potentially eating into your returns

As such, your risk tolerance may help you to determine which stock would suit you more.

#3 Trading volume

The trading volume of a stock can influence your decision to own a particular stock.

Suppose you are an investor who has a high tolerance for risk, then owning TCEHY would be more in line with your goals. Otherwise, TCTZF would be more suitable for you.

In any case, both stocks do not actually have huge differences in their stock performance. It also helps to know that TCEHY is more popular with investors due to their higher liquidity.

#4 Fungibility

The ability to convert between the US stock and its Hong Kong stock can be something to consider depending on your needs.

While some investors like this factor because they want to profit from arbitrage, others simply prefer the flexibility on its own.

It would be beneficial to think about your needs. If you do not wish to convert between the US and Hong Kong shares, owning either one would not matter in this aspect.

Conclusion

To conclude, both TCEHY and TCTZF are ticker symbols that represent Tencent Holdings. They are both listed on the US OTC markets which serve to provide companies with easier access to US investors.

With regards to the dangers of an OTC stock, Tencent is largely not affected by them. This is because their stock performance follows that of its Hong Kong listing, the 0700 ticker symbol.

With China’s restrictions in place, its local companies have also sought a way to continue raising capital from the outside. This is done via the VIE structure. Yet, this also means that investors in TCEHY and TCTZF do not actually have an ownership in Tencent.

However, they are not too much of a worry for now as China has not indicated any disapproval of this structure.

Moreover, the decision to own either stock is determined by your risk tolerance. If you can withstand the exchange rate fluctuations and the huge swings in the market, then you might be comfortable with TCEHY.

For investors who have a lower risk tolerance, TCTZF would be a safer option.

In addition to buying the stocks on the OTC markets, you can choose to invest in ETFs that possess Tencent in their holdings. Notable examples are Hang Seng Tech ETF and Hang Seng Index ETF. They have a rather high percentage dedicated to Tencent’s shares!

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?