With Singapore aiming to go chequeless by 2025, cheques are not as common as in the past.

However, you may still receive a cheque, and you may be wondering about the process of receiving the funds from the cheque to your bank account.

Here’s what you need to know:

Contents

How do I deposit a cheque in Singapore?

Here are 3 steps you’ll need to deposit a cheque in Singapore:

- Select a bank account in your name that you want to deposit the funds to

- Fill up your bank details (Account number, Name and Contact number) at the back of the cheque

- Deposit your cheque at a deposit box of the bank that you wish to deposit your funds into

And here is each step explained in-depth:

#1 Select a bank account in your name that you want to deposit the funds to

The first thing you’ll need to do is to decide which bank account you would like your funds to be deposited to. This bank account has to be in your name, or it can be a joint account where your name is one of the payees of the account.

The bank that you choose does not need to be in the same bank that the cheque was issued by, which is something that we will be covering later.

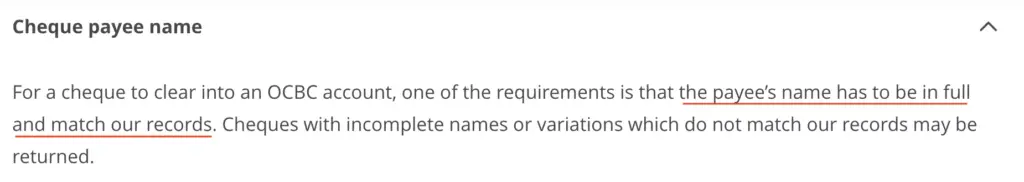

Another thing to note is that the name on the cheque has to be exactly the same as the name that is in the bank records.

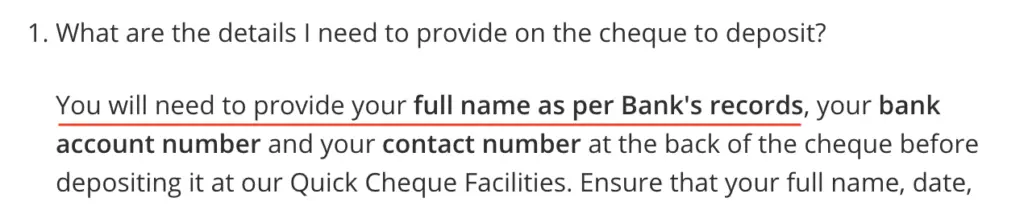

This was mentioned by OCBC,

DBS,

and UOB.

As such, it will be good to double check that the name in your check exactly matches the name that is in the bank’s records!

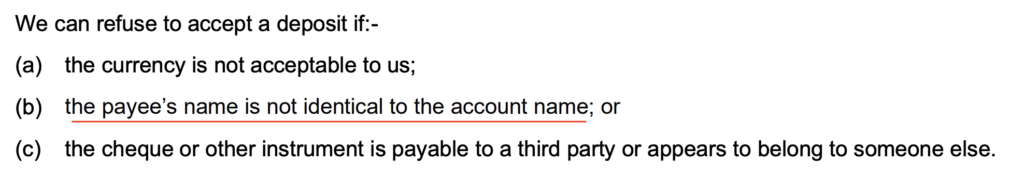

#2 Fill up your bank details (Account number, Name and Contact number) at the back of the cheque

The next step will be to fill up your bank details at the back of your check.

This includes:

- Account number that you have chosen

- Name

- Contact number

This account number has to come from the bank that you intend to deposit to. For example, you should be using an OCBC bank account number if you intend to deposit this check at the branch at an OCBC bank branch.

It will be good to double check all of these bank details to ensure that your check does not bounce!

#3 Deposit your cheque at a deposit box of the bank that you wish to deposit your funds into

The last step will be to deposit your cheque at a cheque deposit box.

These boxes are usually found in the bank branches of the banks in Singapore, such as:

After you have deposited your cheque, the funds will be credited into your account after it has been cleared. It took around 1 business day for my funds to be cleared.

Can I deposit a cheque from a different bank?

It is possible for you to deposit a cheque at a different bank than the one that is on the cheque. The bank that is on the cheque is just the issuing bank on the cheque. However, you are able to deposit this cheque into any bank account that has the same name as the one on the cheque.

One common misconception you may have is that you have to deposit the cheque into the same bank as the one that is shown on the cheque.

However, this is not the case!

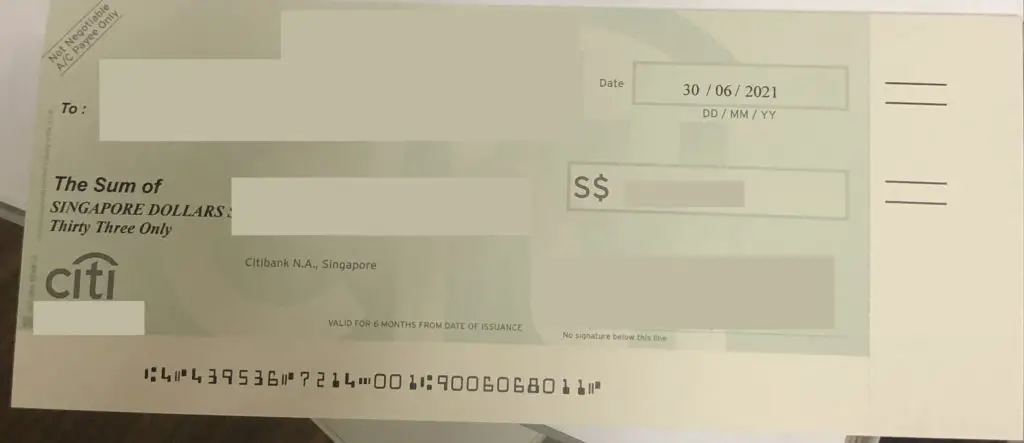

The bank name that is on the cheque is the issuing bank. This is usually the bank that the payer is using to transfer the funds to you.

However, this does not mean that you have to deposit the cheque into a bank account from the same bank. You are able to deposit this into any bank that has an account under your own name.

For example, the cheque that I received was from Citibank. However, I was able to deposit my cheque into my OCBC Frank Account.

How do I deposit a cheque from another bank?

To deposit a cheque from another bank, you will need to ensure that you have written an account number that belongs to this other bank and that it is under your own name.

In my case, I wrote my OCBC Frank Account number on the Citibank cheque, which allowed me to deposit the funds from the cheque to this account.

Can I deposit a DBS cheque at a POSB branch?

It is possible for you to deposit a DBS cheque at a POSB branch, or vice versa. This is because DBS and POSB are the same bank, and your funds will be transferred to the corresponding account based on the account number that you’ve written.

Since DBS and POSB are actually the same bank, there is no issue to deposit either a DBS or POSB cheque into a POSB or DBS cheque deposit box respectively.

As such, you can write your DBS or POSB account number behind the cheque. DBS account numbers usually contain 10 digits, while POSB account numbers have 9 digits.

Can I deposit an OCBC cheque into DBS, POSB or UOB?

It is possible for you to deposit an OCBC cheque into a DBS, POSB or UOB cheque deposit box. You will need to ensure that you have written a bank account number under your own name before you’ve deposited the cheque into the bank branch.

Can I deposit a UOB cheque into DBS, POSB or OCBC?

It is possible for you to deposit a UOB cheque into a DBS, POSB or OCBC cheque deposit box.

Can I deposit a Standard Chartered cheque into DBS or POSB?

It is possible for you to deposit a Standard Chartered cheque into a DBS or POSB cheque deposit box.

Can I deposit a DBS cheque into OCBC or UOB?

It is possible for you to deposit a DBS cheque into an OCBC or UOB cheque deposit box.

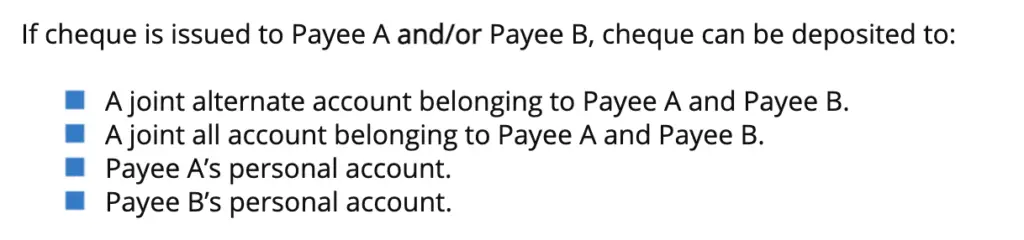

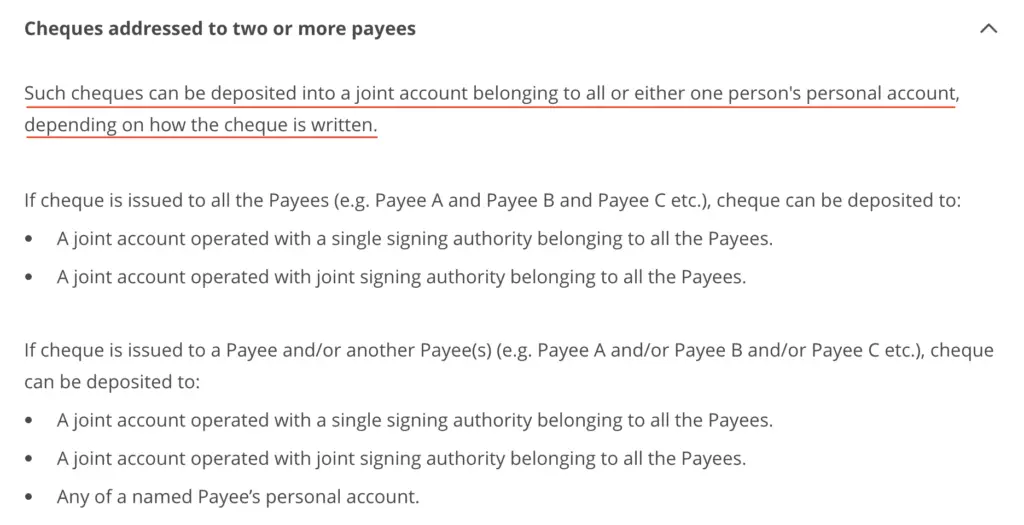

Can a single name cheque be deposited into a joint account in Singapore?

A single name cheque can be deposited into a joint account in a Singaporean bank, provided that the recipient is one of the payees of the joint bank account.

It was mentioned on DBS and POSB’s website that you can deposit a cheque under a single name into a joint account with another payee.

This is also possible for cheques to be deposited to OCBC.

Can I deposit a foreign cheque in Singapore?

It is possible to deposit a cheque denominated in foreign currency into a Singapore bank account. However, there may be some clearing fees charged, as well as currency exchange related fees if the foreign currency is to be converted into SGD.

While you can deposit foreign cheques to a Singaporean bank, there will be some fees that you’ll incur:

| Bank | Foreign Deposit Cheque Fees | Min and Max |

|---|---|---|

| DBS / POSB | Free for USD 0.125% of cheque value for other currencies | Min. $10, max $100 |

| OCBC | Free for USD 0.125% of cheque value for other currencies | Min. $30, max $100 |

| UOB | 0.125% cheque value | Min. $10, max $50 |

| Maybank | Free for USD 0.125% of cheque value for other currencies | Min. $25, max $100 |

If you wish to deposit a USD cheque, it would be best to deposit it to any bank except for UOB!

Conclusion

When you are depositing a cheque to your bank account, it does not need to be from the same bank as the one that issued the cheque.

So long as you deposit it into a bank where you have a bank account under your name, it will still be able to be processed and the funds will be deposited into your account!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?