Last updated on March 8th, 2022

Alibaba Group is a multinational technology company that focuses on e-commerce and retail. It is China’s largest e-commerce company. Some also say it is the Amazon of China.

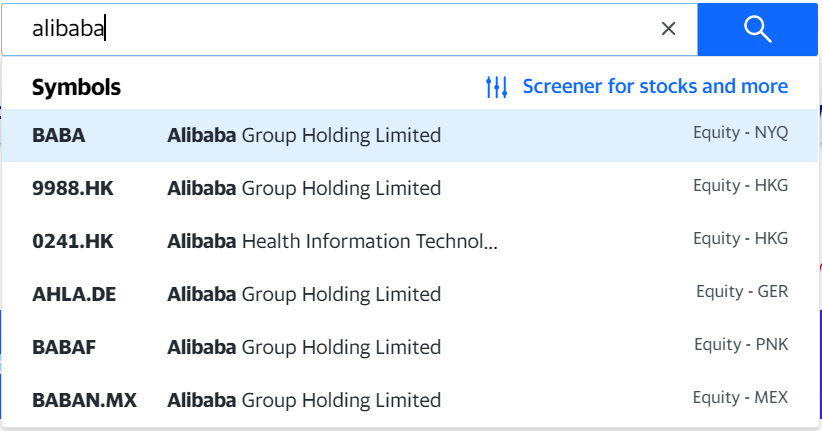

As a public company, it is listed on several exchanges and markets. This provides easier access for investors to trade its shares.

Among the stock symbols, two of them are quite similar. They are represented as BABA and BABAF.

In this article, let’s delve into Alibaba and the differences between the two ticker symbols.

Contents

The difference between BABA and BABAF

Both of them represent Alibaba Group. However, BABA is an ADR on the NYSE, while BABAF is an ordinary share on the US OTC market. This also means they differ in their trading process and trading volume.

Before we explore their differences, it would be useful to understand a little bit more about where they came from.

Back in September 2014, Alibaba first listed itself on the New York Stock Exchange (NYSE). Its ticker symbol was chosen as BABA.

But wait, why did they choose to list it on NYSE rather than the Shanghai or Shenzhen Stock Exchange?

There are a few advantages that made Alibaba decide to list on the NYSE. They are

- control

- reputation

- range of motion

Following that, Alibaba applied to be listed on the over-the-counter (OTC) market as BABAF. An OTC stock can also be referred to as an unlisted stock.

However, why would a company choose to be listed on the OTC markets?

OTC markets are rather different from a standard market exchange. Companies often choose to list their stocks there for a number of reasons. They include:

- low regulations

- low listing fees

These benefits are in comparison to a standard exchange. For those reasons, they have attracted small companies to list their stocks there too.

Now that we understand where these ticker symbols come from, let’s talk about their differences.

They are traded in different markets

BABA and BABAF are traded in different markets, but what does that mean? What are the risks involved?

NYSE is known as a reputable US exchange. Being listed on it comes with its own regulations that must be followed. These regulations are upheld by the Security & Exchange Commission (SEC).

One example of a regulation is the consistent delivery of financial information to the public.

This information must be accurate, complete and of quality. If they are not followed, the company will run the risk of getting delisted.

That also means they will not be allowed to list on the US exchanges. As such, they would have to resort to listing their stocks on lower reputable markets.

In the event that happens to Alibaba, it would be devastating to their reputation. Subsequently, it would affect their ability to attract foreign investments in the future!

Low reputable markets include the OTC markets. They are known to contain smaller companies. Companies who were unable to meet the listing requirements of the standard US exchanges.

OTC markets do provide easier access for companies. However, they are not without their drawbacks. Some examples are low liquidity and high volatility.

As opposed to most OTC stocks, BABAF does not suffer from the drawbacks. Instead, its performance generally follows that of the BABA stock.

As such, it is not a huge concern for Alibaba to list their stock on the OTC market.

Different trading process

The process of trading on the OTC market is different compared to a standard exchange. On the outside, you can buy and sell the shares through a broker’s platform. Internally though, they are carried out differently.

When stocks are listed on a standard market exchange, the shares are traded through an automated software system. This has important consequences:

- price quotations are accurately recorded

- trades are effected instantly

In contrast, trades in the OTC market are negotiated via the telephone. The manual procedures inevitably results in unreliable information and execution delays.

If you are looking to trade on the OTC market, it is good to understand these shortcomings.

Type of holding

A BABA share is an American Depository Receipt (ADR), while a BABAF share is an ordinary share of Alibaba.

What is an ADR though?

ADRs are a form of equity security that was created specifically to simplify foreign investing for American investors.

Fidelity

To identify ticker symbols that are ADRs, you can do a quick Google search. Shares that are ADRs will have ‘ADR’ at the back of their name.

Ordinary shares do not pose any risks to the investor, but ADRs do.

These risks include exchange rate risk and inflation risk.

Moreover, Alibaba operates their business through a Variable Interest Entity (VIE) structure. This is due to China’s regulations to control foreign ownership. As a result, investors holding BABA or BABAF shares do not actually have an ownership in Alibaba. Rather, they own the VIE structure.

Because of this, investors also do not have voting rights in Alibaba.

Different trading volume

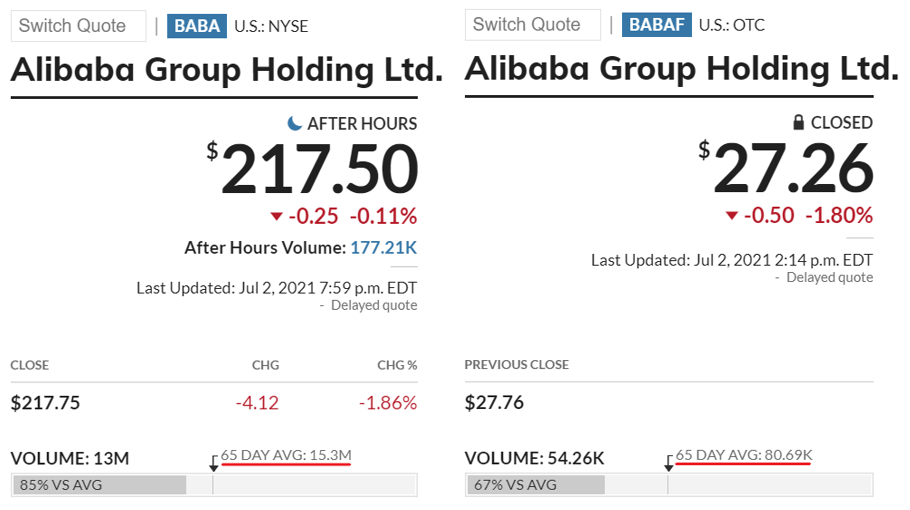

With regards to their 65-day average trading volume, BABA has 15.3 million worth. In contrast, BABAF has only 80.69 thousand.

BABA’s trading volume is much higher compared to BABAF!

Alibaba is a popular brand among US investors so it seems reasonable that it has high trading volume.

But, why does BABAF lack in comparison?

As mentioned, OTC stocks have a more complex method of trading. This often causes delays in the trading process, resulting in fewer trades being made. A low trading volume is not a bad thing per se, but it does prevent the investor from making higher returns.

At the same time, a high trading volume is not necessarily good either. While it does provide the possibility of high returns, there are risks involved.

High trading volume means that the stock prices can experience sharp jumps in the market. It takes an investor with a high risk tolerance to be able to withstand them.

As such, it is important to know what you are looking for as an investor.

If you wish to reduce the risks of holding ADRs, it may be better to convert them to its ordinary shares.

BABA shares can be converted to its ordinary shares. However, BABAF cannot be converted in this case.

This is because BABA shares are actually ADRs.

If you want to own ordinary shares, buying BABAF is one option. However, another way you can go about is by converting your BABA stock to the stock that is listed on the HKEX: 9988.

9988 is a more ‘reputable’ stock with a higher trading volume compared to BABAF. As such, it may be a better choice to choose 9988 over BABAF!

Verdict

After doing a comparison between the two stocks, here is a summary:

| BABA | BABAF | |

|---|---|---|

| Type of Market | NYSE | OTC maket |

| Trading Process | Automated | Manual |

| Type of Holding | ADR (VIE) | Ordinary share (VIE) |

| Trading Volume | High | Low |

Choosing between these two stocks may be difficult. Here are some points you can consider in your decision:

#1 Type of market

A NYSE listing establishes the company as reputable and credible among investors. This consequently attracts investors to put their money into buying BABA shares. As such, it raises the stock’s liquidity.

Conversely, BABAF in the OTC market would have difficulties making good profits for its investors. This is because the OTC markets in general have a lower reputation. As such, the stocks listed there are also unpopular.

Suppose you are an investor who wants to aim for higher returns, BABA shares would be more suitable.

#2 Trading process

The difference in their trading process can be a key factor for your decision.

An automated process is often more reliable. And it is faster in matching the volume of trades that are occurring today. On the contrary, manual processes can introduce errors and delays in trades.

If you seek reliability and accuracy in your trades, BABA would be a better stock to go for.

#3 Type of holding

Since BABA shares are ADRs, they can pose slightly more risks to the non-US investor. These risks can potentially reduce your profits!

As such, BABAF would be more appealing if you are a non-US investor.

#4 Trading volume

A high trading volume for a stock can create huge swings in their stock prices. This can be viewed differently depending on your goals and risk tolerance. While some see it as a way of getting great returns in the market, others foresee quick losses.

If you have a high risk tolerance, then BABA is a good choice for getting higher returns.

Conclusion

To sum up, both BABA and BABAF are ticker symbols that represent Alibaba Group. They are both traded in the US, though in different markets.

BABA is listed on the reputable New York Stock Exchange. Whereas BABAF is listed on the over-the-counter market. This creates several differences in the nature of their stock.

BABA, on one hand, is seen as more popular among investors. This is because they can generate good returns on their investment. Despite having high volatility, they are also not frown upon by investors. Instead, it is one of the factors that make it possible to earn high returns.

On the other hand, BABAF would be out of favor as it is traded on the less reputable OTC markets. Its trading process can encounter delays and may be unreliable. In addition, it has low volatility. As a result, investors would not have a good chance of getting high returns.

The decision to buy either stock is determined by your own goals and risk tolerance.

Assuming you have a high risk tolerance who wish to make high returns for yourself, then BABA would be the better option.

However, if an OTC stock with a manual trading process and low volatility does not deter you, then BABAF is more suitable. On top of that, you would be holding ordinary shares of Alibaba. This would pose no US currency risks to non-US investors!

Besides buying the stocks on the markets directly, you can opt to invest in ETFs that have Alibaba in their holdings. Some examples include Hang Seng Tech ETF and Hang Seng Index ETF. They have a rather high percentage dedicated to Alibaba’s shares!

If you’re looking for a way to track the markets and your portfolio, you can consider using TradingView, which allows you to monitor more than 50 stock exchanges.

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?