Two tokens, one company: VeChain (VET) and VeThor (VTHO) are two coins that are managed by the same company, VeChain. But why are there two different coins for the same company?

In short, VeChain is a platform that focuses on supply chain management. VeChain has many names, including VeChain Foundation and VeChain Thor.

For this article, we’ll refer to the company as VeChain.

Let’s break down the differences between the two coins!

Contents

The difference between VET and VTHOR

VET is used to store and transfer value while VTHO is required to perform transactions. VET is generally used by retail investors while VTHO is designed for enterprises to use. VTHO is generated from holding VET tokens. VET and VTHO exist in a dual-token economy.

Main Purpose of Coins

The VeChain network uses two different tokens: VeChain (VET) and VeThor Energy (VTHO). However, the generation and purpose of the two coins are different.

Let’s explore the differences in detail!

VET as a coin for investors

VET is the primary coin on VeChain. Its main purpose is to serve as a “value-transfer medium”. This means VET is the currency for the different business activities on the platform.

When you hold VET, VTHO is being generated. According to VeChain, VET represents the right to use their blockchain. By having VET, VTHO is created for users to take part in the blockchain. This can include activities like releasing smart contracts on the blockchain.

VTHO as a coin for businesses

Other common coins, such as Ether (ETH), are being used for both holding and payment. In Ethereum, the price of gas is directly proportional to that of ETH. Unlike other networks such as Ethereum or Chainlink, VeChain has a separate coin to pay for transactions on the network. This token is known as VeThor Energy (VTHO).

VTHO is used to execute smart contracts on the VeChain blockchain. When you execute a smart contract or dApp, you need to use energy to process it. It is the same concept as running an app on your phone, that app consumes energy from your battery.

On VeChain, the energy required for executing smart contracts is paid using VTHO.

Essentially, VTHO was created to prevent market speculations and cause wild fluctuations in prices.

The unique two-token system (VET+VTHO) significantly helps separate the cost of using blockchain from market speculation.

VeChain

VeChain’s primary business is providing companies with blockchain solutions. To keep the network affordable for these companies, the price of VTHO is to be relatively stable.

Thus, VeChain needs to keep transaction prices stable. When the price of VTHO increases, the amount needed to process a transaction is reduced.

This means the price of a transaction is the same.

So, what’s the main difference?

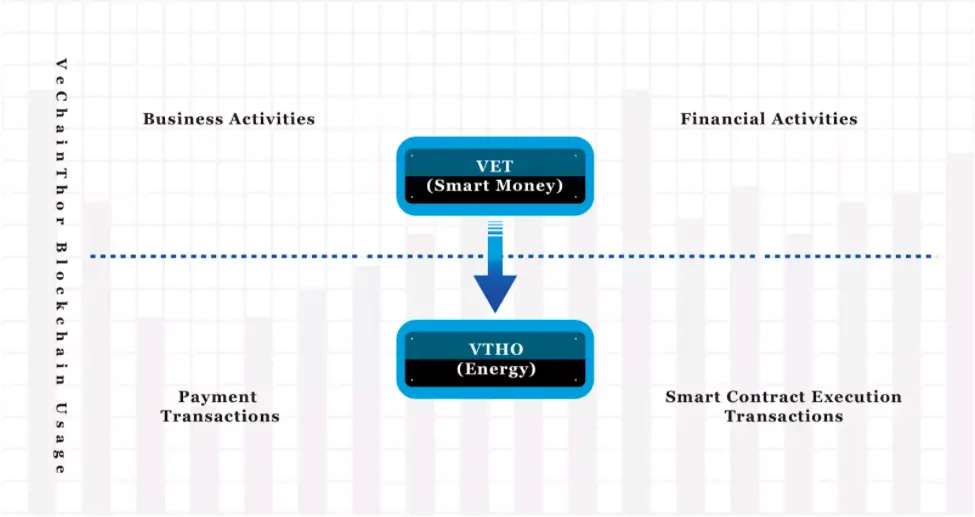

Source: VeChain Whitepaper

The VeChain ecosystem is special as it adopts a dual-token economy. Both of these tokens together empower the economic infrastructure of VeChain. Usually, there is only one token for each blockchain.

To reduce volatility on the network, VTHO is developed. VET is more for business and financial activity while VTHO is more for technical transactions. Technical transactions include payments on the chain and executing smart contracts.

Investment Value

After discussing the purpose of these coins, let’s get into the technicals of the coins, such as total coin supply and where it’s being used.

VET as an investment

VET is used as a medium of exchange. It functions similarly to the native coin of other blockchains. It helps business and financial activities to function.

The supply of VET is fixed at 86 billion and will never be increased.

Source: CoinMarketCap

VET can be converted into VTHO at a fixed rate, and VTHO can be generated from holding VET. The generation rate is currently 0.000432 VTHO per VET per day.

Source: CoinGecko

Being more exposed to free-market conditions, the price of VET is more volatile.

As the number of users on the Vechain blockchain increases, the price of VET is also estimated to increase. However, it is still exposed to the overall market conditions. If the general crypto market is down, it negatively affects the price of VET as well.

VTHO as an investment

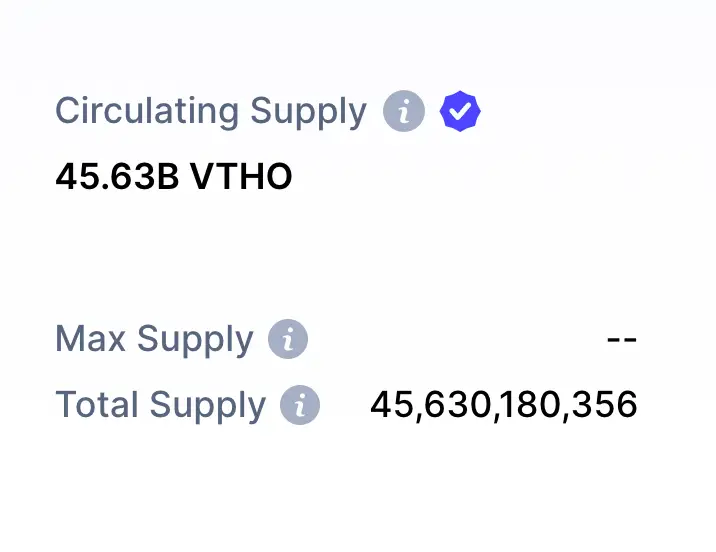

The demand for VTHO comes from smart contract execution and payment transactions. The only way to produce VTHO is by holding VET. Unlike VET, there is an unlimited supply of VTHO.

Source: CoinMarketCap

However, if you need more VTHO, it can also be bought from other users on exchanges. It is good to note that fewer exchanges offer VTHO than VET.

The value of VTHO is closely monitored by VeChain. The supply and price of VTHO change according to how busy the network is and the size of your transaction.

Source: CoinGecko

Like many other networks, the amount of VTHO paid as gas is determined by the size of the transaction processed.

VeChain can decide to change how VTHO is generated or used, whenever necessary. This means that VTHO is mostly centralised and strictly controlled by the company.

The supply of VTHO is a delicate balance. VTHO is created from VET stake while it is burned during transactions. For every transaction, 70% of the VTHO is burned while the other 30% is being used to process the transaction.

So, what’s the difference?

As a casual investor, VET is easier to understand. As a developer, VTHO is more useful. VTHO is designed to avoid volatility so it is a good choice if you would like to invest in a coin that is more stable, while still having a stake in the VeChain ecosystem.

By investing in VET, you can also generate VTHO. This means you get both tokens by holding VET. However, holding VTHO does not give you VET.

Interest rates on various platforms

A great way to earn passive income is to stake coins on platforms and receive interest. It is also easy to set up, compared to participating in nodes and validation.

Since VTHO is purely a technical token, it is usually not offered as a staking option. VET is staked to generate VTHO or more VET tokens.

Let’s explore the different staking options for VET:

| Platforms | Interest Rate (Yearly Rates) |

|---|---|

| Binance | On Staking: 1-3% On Earn: 0.5% – 7.32% |

| Crypto.com | 0.5 % – 5%, depending on duration and number of CROs staked |

| Exodus | 1.03% |

Binance

There are two ways to stake on Binance:

- Stake VET to get VTHO

- Stake VET on Binance Earn to earn VET

By staking VET on Binance, you will receive VTHO tokens as a reward. The estimated yearly reward is 1-3%.

Source: Binance

Crypto.com

To get a higher reward on Crypto.com, you can either:

- Have a higher stake in their native coin, Cronos (CRO) (<400, 4000 and 40,000)

- Stake for a longer term (Flexible, 1 month and 3 months)

You also have to consider the total amount of all your stake on Crypto Earn (≤US$30,000 or >US$30,000).

Combining these 3 conditions, you can calculate the interest rate you are getting.

Let’s look at 4 examples of stake on Crypto.com:

| CRO Staked | Staked Term | Amount of VET you are staking | Amount of Tier 1 staked | Total Interest Rate |

|---|---|---|---|---|

| 400 | Flexible | US$1,000 | US$30,000 | 5% |

| 400 | Flexible | US$30,000 | 0 | 5% |

| 40,000 CRO | 3 Months | US$1,000 | US$30,000 | 2.5% |

| 40,000 CRO | 3 Months | US$30,000 | 0 | 5% |

For more details, do refer to Crypto.com’s website.

Exodus

Another platform to stake on is Exodus. When you stake VET on Exodus, they distribute interest in VTHO. As long as there are VET tokens in your VeChain wallet on Exodus, interest in VTHO will be automatically added to your wallet.

You can find out more about staking VeChain on Exodus here.

Use-case of VeChain

VeChain is one of the most promising supply-chain related blockchains. The network is used by many enterprises that need validation and transparency in their supply chain networks. Supply chain data for business processes are not communicating with each other.

Blockchain platforms that focus on use cases such as traceability, anti-counterfeiting, food safety, intellectual property management, product life-cycle management and all kinds of data provenance categories are rarely to be seen.

VeChain Whitepaper 2.0

Tracing our food sources

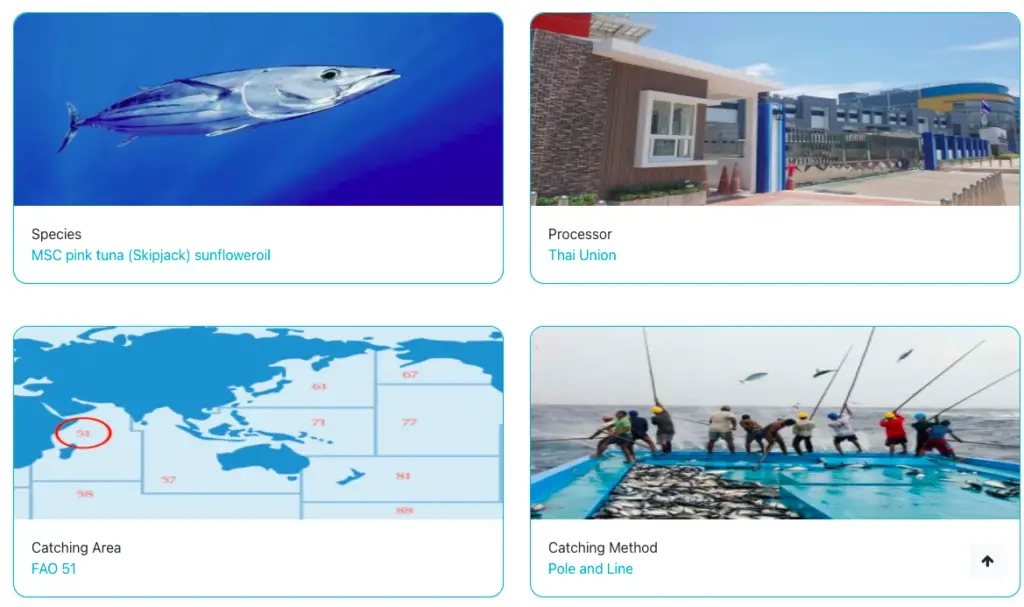

To keep track of its supply chain, a tuna brand, Gustav Gerig, uses VeChain to trace its tuna.

Radio-frequency identification (RFID) and QR codes are attached to fishing vessels and tunas.

The QR code follows the tuna from the fishing vessel to the processing area, to the hands of the consumer.

This is a common method of tracking used as a part of VeChain technology.

By scanning a QR code on their smartphones, consumers can view the steps in the tuna supply chain. For example, a can of tuna was tracked by the VeChain network, from where it was fished to where it was processed. The website shows it’s was caught and processed.

Source: Gustav Gerig

This is just one of Vechain’s many use-cases. Other use cases include anti-counterfeit, tracking carbon emissions and many others.

Origins of VeChain

In 2015, Sunny Lu founded VeChain, which rebranded to VeChainThor in 2018. Recently, the company is known as VeChain Foundation, while the network is known as the VeChain blockchain.

While working as the Chief Information Officer of Louis Vuitton China, Lu saw a problem in the luxury sector. Luxury goods are difficult to authenticate. Moreover, counterfeit luxury goods can be easily found in the market.

Louis Vuitton is one of the most counterfeited luxury goods in the world.

Source: VeChain Medium

With this problem in mind, he realised that blockchain has the potential to solve this issue. Blockchain can make sure that items are authentic. This is especially useful in the luxury industry, where counterfeiting is a big issue.

This sets up a perfect niche for VeChain. They used blockchain for authentication, starting in the fashion industry. This is done by recording the unique code of the item on the blockchain.

This also enables the potential of derivative businesses such as ownership transfers, warranties, empowering the development of new verticals in luxury secondary markets such as re-financing and insurance.

VeChain Whitepaper

This also opens up doors for other applications, such as providing transparency in the supply chains.

Vechain launched in 2015, which is considered early for a blockchain solution company. During the launch, VeChain began as a company that is part of BitSE, which is one of the largest blockchain companies in China.

With the team members’ connections, VeChain already has established companies in its portfolio. They have been working with big companies such as LVMH (the parent company of Louis Vuitton) and PriceWaterhouseCoopers (PwC).

Final Verdict

| Factors | VeChain (VET) | VeThor (VTHO) |

|---|---|---|

| Company | VeChain | VeChain |

| Maximum Supply | 86 billion | Unlimited supply |

| Purpose | Investment, business | Payment for smart contracts execution |

| Main users | Investors | Developers |

| Best interest rate for staking | 7.32% on Binance Earn | – |

| Staking Options | Various platforms available | Close to no platforms available |

| Price levels | Mainly up to the free market | Can be controlled by VeChain Foundation |

| General volatility | More volatile | Less volatile |

Consider VET if you are investing in VeChain as a company

The price of VET is more close to the market price. It is what the market perceives the value of the company to be, similar to a company’s stock.

VET is a coin that is designed for investors of VeChain. By holding VET, you also have the chance to stake and earn more VET or generate VTHO. It is a better long-term investment.

Consider VTHO if you are transacting on the VeChain network

Fundamentally, it is a network whose main customers are the enterprises that use their network. They have to keep coin prices stable, so their customers can transact at an affordable price. The price of VTHO will not fluctuate as much as VET. When the prices of other coins rise, VTHO may be kept low and stable.

Conclusion

Both coins are from the same company, but they serve different purposes.

They differ in terms of the total supply of coins, the target audience and tokenomics.

There is a steep learning curve to understand the VeChain system. However, the applications of the system are straightforward and provide real value to the supply chain problems that we face.

VeChain is a promising company and VET and VTHO are interesting coins to have in your portfolio. This novel approach of having two types of coins in the same company has its supporters and skeptics. What is your take on it?

Do you like the content on this blog?

To receive the latest updates, you can follow us on our Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?