Last updated on June 6th, 2021

Are you able to predict what will happen to you in the future?

A recent survey conducted by OCBC shows that only 30% of Singaporeans can cover their expenses for 6 months, if they lose their job now.

We’ve all heard about “saving for a rainy day”. Having some savings to tide you through tough periods is crucial, especially in this uncertain job market.

Here’s a guide to emergency funds, and how you can start building up your cash reserves.

Contents

- 1 What is an Emergency Fund for?

- 2 Are savings the same as an Emergency Fund?

- 3 Should I prioritise my emergency funds over other financial goals?

- 4 How much should I have in my Emergency Fund?

- 5 Where should I place these Emergency Funds?

- 6 Should I invest my Emergency Funds?

- 7 How do I start building up my Emergency Fund?

- 8 What’s next after building my emergency fund?

- 9 Conclusion

What is an Emergency Fund for?

An emergency fund is an important part of all financial plans.

They should only be used in the event of an emergency.

An emergency is defined as “a serious, unexpected, and often dangerous situation requiring immediate action”.

It is very important to understand what an emergency is. This gives you a very strict criteria on when you should be using these funds.

Some examples of an emergency are:

- Losing your job

- Taking no-pay leave for certain situations

- Unexpected medical expenses (e.g. an accident)

- Unexpected travel expenses

- Emergency home repairs

Most of these examples are unexpected, and are usually urgent or even life-threatening.

The emergency fund provides you with funds for these large payments. It also provides you with some money to last through a period of time after losing your job.

What you should not use your emergency funds for

Here are examples of what you should not be using your emergency fund on:

- Buying the latest phone or clothings

- Anything that is planned (medical, travel etc.)

Having a strict criteria restricts the use of your emergency funds to only a few scenarios. They are only for true crises.

Is an emergency fund really that important?

You may ask yourself, do you really need an emergency fund?

If you’re still on the fence, look no further than the Singapore government.

During the COVID-19 pandemic, the government has released 4 budgets.

The budgets include:

- Unity Budget ($6.4 billion)

- Resilience Budget ($48.4 billion)

- Solidarity Budget ($5.1 billion)

- Fortitude Budget ($33 billion)

Altogether, these 4 budgets cost $92.9 billion. The government has drawn up a total of $52 billion from our national reserves just to cope with the COVID-19 crisis!

Although the size of our reserves cannot be disclosed, it just goes to show the size of the reserves that Singapore has.

Just imagine, if the government did not save that much money along the years, would they be able to give such huge payouts?

I’m pretty sure that our economy would have been hit harder if we didn’t have these reserves to draw on.

Companies have emergency funds too

Companies have cash reserves as well. These reserves help them in the event of any crises.

100-200 football clubs face the prospect of going bankrupt due to COVID-19. Due to the cancellation of matches, many clubs face a loss of revenue from both television deals and matchday revenue.

In contrast, established and well-run companies usually have huge piles of cash. For example, Berkshire Hathaway has a cash reserve of $137 billion!

Situations like the COVID-19 pandemic are not predictable. We will always need a safety net to ensure we are well prepared for any curveballs in life.

Are savings the same as an Emergency Fund?

Emergency funds can be considered as a subset of savings.

Your savings are usually split into 3 main categories:

- Emergencies (i.e. emergency funds)

- Short-term goals (e.g. education, housing)

- Long-term goals (mainly retirement)

It is important to distinguish between an emergency fund and a fund for a short-term goal.

The money that you’re saving for both goals should be in separate accounts.

As stated above, the emergency fund is only used for emergencies under a very strict criteria.

For short-term goals, you can save for any large, planned purchases.

Ideally, you should build up your emergency fund first, before saving for your short-term and long-term goals.

This will give you a peace of mind when saving for these goals. You would not need to compromise your goals to pay for these emergency expenses.

Should I prioritise my emergency funds over other financial goals?

I believe that emergency funds should be the main financial goal that you prioritise.

Even if you’re in debt, it is still recommended to build up your emergency funds first.

This is because while trying to pay off your initial debt, you may encounter an emergency along the way.

If you don’t have any emergency funds, you’d need to take an additional loan to cover these expenses too!

No one can predict what will happen tomorrow. Emergency funds help to provide a safety net against such situations.

You should have an emergency fund before starting to invest

It is highly recommended that you have an emergency fund before you invest too.

Investing has really high risks, and it is possible to lose all your money in the stock market.

Even if you’ve lost everything, you still have your emergency funds to fall back on.

As such, emergency funds should be the first thing you should start prioritising today.

Once you’ve built up your emergency funds, you are able to begin your investing journey! You can read my starter guide to investing to find out some key things you need to know before starting to invest.

How much should I have in my Emergency Fund?

The size of your emergency fund is usually based on your monthly expenses.

Preferably, it should cover all of your essential expenses, such as:

- Food and transport

- All necessary subscriptions

- Rent and other liabilities

- Parents’ allowance

During a long layoff, it would be best to cut down on all other non-essential expenses. Entertainment and dining out would be the first things to go!

You may choose to save based on your monthly income as well, to save the hassle of tracking your expenses.

(This is not recommended as you may be saving too much and losing out on earning more from investing!)

So how many months of expenses should you be saving?

There is no perfect answer. Ultimately, it depends on your financial situation.

Here’s a rough guide on the recommended number of months.

| Type | Number of Months |

|---|---|

| Student / NSF | Depends (3-6 months) |

| Single Income | 6 months |

| Double Income | 3 months |

| Self-Employed | 12-24 months |

#1 Student / NSF

If you are a student or NSF, the amount of emergency funds that you should save is rather complicated.

There are many things to consider before you decide on an amount that suits your needs:

- Are your parents still working?

- Do you have a study loan?

- Are you receiving allowance from your parents or working part time?

Once again, you should consider your monthly expenses.

If you have a part time job or are receiving allowance that can cover your expenses, you may not need that much funds. Perhaps having 3 months is sufficient for you.

As a student, you have lesser things to worry about compared to a working adult.

Even so, you should still be prepared for any emergency. Anything can happen and the best thing you can do is to have some buffer against a crisis.

Having too much savings can be disadvantageous too.

Since you are young and have a longer time horizon, you definitely should consider investing some of your money!

Before investing, remember to build up your emergency funds first!

Furthermore, if you’re able to cultivate a saving habit since young, it’ll make saving so much easier in the future!

#2 Stable Income (Single / Double)

If you have a stable job, the amount that you should have is pretty straightforward.

Most people recommend 3-6 months of expenses as your emergency fund.

If you are the sole breadwinner, having 6 months would be better as losing your job will have a greater impact on your family’s finances.

If both you and your partner are working, losing your job may not have as much of a financial impact.

The chances of you and your partner losing your job at the same time is there, but the risk is low.

You may be able to survive financially with just 3 months of expenses.

#3 Self-Employed

If you’ve lost your job, you’ll be expecting to have zero income for the period until you find a job. Thus, the emergency fund should help you to last this whole period.

This is especially if you’re self-employed, where your job security is even more uncertain.

Your income is really unstable as well. You may earn more in certain months, but have a lower income in other months.

Having these emergency funds ensures that your essential expenses are still covered.

In a podcast episode by The Financial Coconut, the host, Reggie, conducted an interview with Samuel, a freelance photographer.

During the interview, Samuel mentioned that he has 24 months of monthly expenses for his emergency fund!

If you’d like to listen to the section of emergency funds, you can jump to the 10:30 mark in the podcast episode below.

Having at least 12 months worth of emergency funds as a freelancer is crucial to ensure some financial stability, even in times of crisis.

The recommended amounts are just a guide

I would like to stress that this is just a guide and not something that you must definitely follow.

If you are comfortable with saving less, you can go ahead with that too!

Also, I believe that an emergency fund should be an absolute number, rather than a percent allocation of your total wealth that you need to achieve.

Since it is based on your monthly expenses, your emergency fund should only increase when your expenses increase.

Your lifestyle may change over time as well. As you have to look after your children or elderly parents in the future, the amount that you need may eventually be higher.

As such, your emergency fund needs to be dynamic and adapt to your needs accordingly.

The most important is to have a sum that can sustain you throughout the uncertain times.

Can I have too much money in my Emergency Fund?

However, it is also possible that you can have too much money in your emergency fund.

By having a large emergency fund, you are forgoing the opportunity to make your money work harder for you.

A balance is needed between:

- Having a safety net

- Investing the rest of your money to beat inflation

The returns you get by investing are definitely much higher than if you just leave your money in the bank.

By considering the opportunity cost, it’ll help you to determine the optimal amount of emergency funds you should have.

Where should I place these Emergency Funds?

Here’s the number one rule when it comes to emergency funds:

You should place your emergency funds in somewhere that is highly liquid.

A highly liquid asset is one that allows you to access the funds easily.

This is because some emergencies require you to have cash at hand immediately, such as urgent medical expenses.

I would recommend placing them in a bank savings account. These are usually the most liquid of all options.

Ideally, the account should have as little requirements as possible.

With interest rates being so low, bank accounts may not be the most ideal option. You may not even be able to beat inflation with such returns!

However, I feel it is a trade-off between interest rates and liquidity.

Personally, I’m using 2 accounts for my emergency funds:

The SingLife Account has a great interest rate (2% for the first $10k) with very little requirements.

However, it does have slight liquidity issues.

There is a lag time between sending the request and the money appearing in your bank account.

I have written a review on the SingLife Account if you wish to find out more about this unique product.

Savings accounts have the highest liquidity

This is why I place some of my emergency funds in the JumpStart Account too.

It is a savings account that has FAST transfers. Thus, you are able to have easy access to the funds in the account.

The only tradeoff is that you’ll receive a pretty low interest rate for funds in your bank account.

Choose bank accounts with little requirements for your emergency funds

Other bank accounts would have certain requirements before you can earn the bonus interest.

These include:

- Minimum spending

- Salary credit

- Investing with the bank

- Signing up for insurance with the bank

Accounts with such requirements are not ideal for an emergency fund.

This is especially for the spending requirement, which defeats the purpose of saving for an emergency fund!

Compared to the other bank accounts out there, the FastSaver Account is the next best option after JumpStart.

Also, I would recommend you not to place your emergency funds in these few instruments:

| Instrument | Reason |

|---|---|

| Fixed Deposits | Minimum lock-up of 3 months Will be penalised if you withdraw earlier |

| Singapore Savings Bonds (SSBs) | $2 fee for every redemption request One month notice required when redeeming SSB |

| Insurance Savings Plans | Can only withdraw in multiples (e.g. $100, $500) May have transaction fees |

| Cash Management Solutions | Takes a few business days before the money is transferred to your bank account |

| Insurance Policies | Takes time for payout to be processed More for income protection rather than emergency funds |

Most of these options either have:

- Liquidity issues

- Strict requirements when withdrawing money

- Transaction fees incurred with every withdrawal

In my opinion, the SingLife Account + no-frills savings account combination is still the best option for your emergency funds.

Should I invest my Emergency Funds?

I would recommend against investing your emergency funds.

The stock market is volatile. In the short term, you may experience price drops.

If you are forced to liquidate your assets due to an emergency, you may sell your stocks at a loss.

This is definitely not ideal when you need that certain amount of cash for your emergency!

I strongly believe that you should only invest funds for long-term goals.

Especially when you’re young, you have a long time horizon to ride through the short term volatilities.

The stock market will always go up, but only in the long term.

To avoid this risk of losing your capital, I would recommend leaving them in safer instruments such as bank accounts.

How do I start building up my Emergency Fund?

If you have not started building up your emergency funds, fret not!

The next best time to start is always now.

Here’s a quick guide on getting started:

#1 Select an account for your emergency funds

You’ll need to select an account to store your emergency fund.

Here’s some criteria I would look out for:

- Reasonable interest rate (hopefully high enough to beat inflation!)

- Low risk (the lower the better)

- Requirements that are easily attainable (e.g. low or no fall-below fee)

- High liquidity

As mentioned above, I strongly recommend placing your funds in a bank account.

If you are able to stomach the risk, or are willing to forgo some liquidity for higher returns, you may consider other options as well.

Cash management solutions are the next best option, as they provide slightly higher returns.

However, most of them will take a few business days before the funds are transferred to your bank account.

Ultimately, you should choose an instrument that you’re comfortable with.

#2 Determine your essential monthly expenses

After tracking your expenses, you’ll get a good gauge on your essential spending.

This helps you to determine the bare minimum you’ll need each month if you lose your job.

Not sure how to get started with expense tracking? You can check out this guest article on my blog that gives 8 tips on tracking your expenses!

#3 Decide how many months you want to save for

There is no right or wrong answer to the perfect amount of emergency funds that you should have (you can refer to a rough guide mentioned earlier in this article).

You should decide on an amount that you’re comfortable with, and review it from time to time to ensure that you’re adequately covered.

#4 Start saving!

When you receive your monthly income, you can set aside a portion of it to build up your savings.

How much should you be saving each month? It really depends on how much you’re able to save.

It would be best to save up for an emergency fund first before starting to save up for any other goals.

To decide how much you should be saving, you can refer to this savings goal calculator.

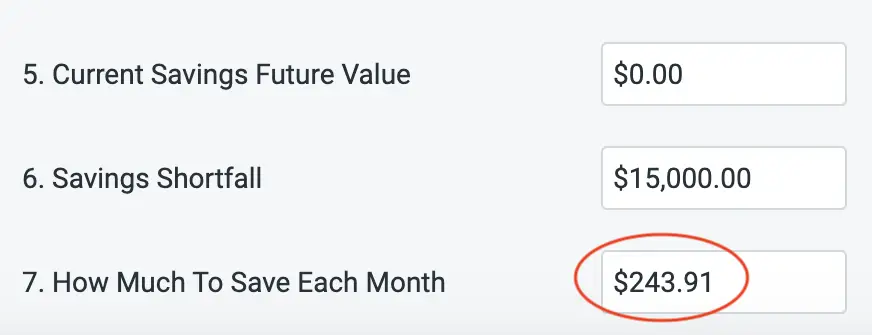

Let’s give a scenario:

You want to save up 6 months worth of your monthly expenses ($2.5k).

You’ll be placing your funds in the JumpStart Account (which provides 1% interest rate), and you aim to have the amount in the next 5 years.

Based on the scenario mentioned above, you’d need to save $243.91 every month to reach $15k worth of emergency funds in 5 years time.

It’s definitely something that’s achievable!

If you receive any extra amounts of money (e.g. bonuses), you should save it too!

This will help you achieve your desired amount in your emergency fund more quickly.

You can play with the calculator to determine the savings rate that is best for your situation.

#5 Replenish your funds after using them

It is ok to use your emergency funds.

They are funds that are meant to be used, but only for those specific scenarios we’ve defined earlier.

After using your funds, it’s just as important to replenish them!

Just as you did when you were building up your fund, you can set aside a portion of your income.

It’ll be much easier to save since you’ve already cultivated the habit!

You can use the calculator again to determine how much you should be saving each month.

What’s next after building my emergency fund?

After you’ve built up a sizeable safety net, you can start focusing on other goals.

You should continue your saving habit, and save a portion of your income.

Instead of building up your emergency fund, you can now channel the savings into another goal.

The top 3 goals that you can aim for are:

- Paying off debt

- Short-term goals

- Long-term goals

Conclusion

Emergency funds are a crucial pillar of your financial plan. There is no correct amount you should as it really depends on your financial situation.

Ultimately, it should be an amount that you are comfortable with.

Having this safety net allows you to pursue other goals without the worry that you do not have enough money.

Still unsure of anything related to emergency funds? You can always contact me to find out more!

Do you like the content on this blog?

To receive the latest updates from my blog and personal finance in general, you can follow me on my Telegram channels (Personal Finance or Crypto) and Facebook.

Are you passionate about personal finance and want to earn some flexible income?